Links in “Credit/Debit Cards”

- One More Reason for National Data Security Standards

A national supermarket chain, SuperValu, Inc., announced that it suffered a potential data breach of its point-of-sale network between June 22 and July 17. The company, which operates 180 grocery stores plus stand-alone liquor stores, is not yet certain whether any debit or credit data was stolen and is continuing its investigation. [8/18/14]

- Whatâs Wrong with Our Current Card Security Programs?

Quite a lot, apparently. In addition to the lack of use of the EMV chip, this expert claims that our current two-factor authentication process is not effective as it does not require out-of-band authentication. In addition, key logger malware, which has proven to be a significant threat, can be effectively thwarted by keystroke encryption programs. [8/18/14]

- What Do Consumers Really Want from Their Financial Institutions?

A recent study reveals that consumers want to be rewarded for their business and loyalty. Whether itâs loyalty cards, cashback offers, loyalty discounts, upgrades, and free nights and flights offered by retailers and credit card providers, consumers want something more than just a good rate. [8/15/14]

- 1 in 2 Cards to be Chip-Enabled by End of 2015

By the end of 2015, it is expected that there will be more than 575 million EMV chip cards in the U.S., or one in two of U.S. payment cards. [8/14/14]

- Retail Credit Card Rates Far Exceed Those at Credit Unions

You need to tell your members that the next time their favorite retailer offers them one of their credit cards, they should think twice! A recent survey shows that on average retail card rates are 200 basis points higher than average credit union card rates. The survey noted that lowest retail rate belonged to Office Max at 9.99% APR, while Toys R Us weighed in with a hefty 26.99% APR. [8/8/14]

- If You Snooze, You May Lose

It appears that a majority of credit unions are going to miss the October 15, 2015 deadline to equip their credit cards with EMV chips. This could be very costly as credit cards without EMV chips will not be eligible for liability relief from credit card losses after that deadline. [8/4/14]

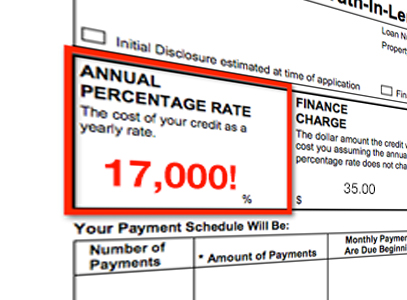

- 17,000 Ways CFPB Is Paving the Way for Overdraft Protection Overhaul

The CFPB released a report revealing the true cost of opting-in to overdraft protection for ATM and debit card transactions, which results in an APR of 17,000%, a number which has captured the media's attention (see, for example, this). Expect significant changes to overdraft protection rules to follow shortly. [8/1/14]

- Eight Ways to Optimize Your Credit Card Marketing

Sometimes low rates and fees are just not enough to attract new credit card applicants. Combine those features with a well-oiled marketing campaign and youâll likely see better results. [7/28/14]

- Deliquency Down, Spending Up

Despite an increase in consumer spending, bank card delinquencies are at 2.44% of all accounts compared to the 15-year average of 3.82%. As James Chessen, ABA's chief economist, explains, "More and more consumers are using their credit cards as a payment vehicle, paying off or paying down their balances each month." [7/10/14]

- Mastercard Extends Zero Liability to ATM and PIN Transactions

Mastercard has announced that it is extending its zero-liability policy to pin-based debit card and ATM transactions for U.S. cardholders in an effort to calm consumer concerns about recent major data breaches. Credit unions were quick to point out that this is already a standard practice in most of their shops. [7/8/14]