Links in “Compliance Tips”

- Shellshock Bashes Systems

The FFIEC is urging financial institutions to protect themselves against the most recent threat, the Shellshock vulnerability. The FFIEC has provided references to help institutions learn what the Shellshock vulnerability is, how to assess risk and what mitigation strategies to put into place. [9/29/14]

- Three Monkeys Approach to ATA Ill-Advised

A circuit court decision suggests that playing blind, deaf and dumb is not a viable business strategy when it comes to the Anti-Terrorism Act. Violations go beyond just knowing that an account is supporting terrorist activities to include knowledge or deliberate indifference that it is supporting a terrorist organization. [9/29/14]

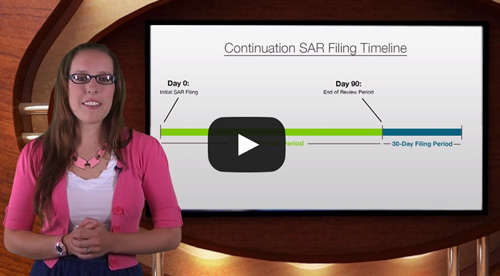

- Risk Watch 31: Continuation SAR Conundrums

When a financial institution identifies a suspicious activity related to a previously filed SAR and that activity is within a specified timeframe, it needs to file what is called a continuation SAR. The timeframe and what goes in a continuation SAR frequently trip up financial institutions. In this episode, AffirmX Analyst and SAR specialist Rachel Osborn helps us sort out these common trouble spots. [9/26/14]

- TILA-RESPA: What to Do “Between Now and Then”

NAFCU is offering advice to the credit union unsure of what to do between now and the implementation of the TILA-RESPA rule, which is still nearly a year away. [9/26/14]

- Anti-Terrorism: What You Need to Know about the Recent ATA Rulings

Earlier this week, there were two court decisions made against financial institutions for violating the Anti-Terrorism Act (ATA). Find out what they did and how you can avoid it. Hint: Record Retention and a robust AML compliance program are important. [9/25/14]

- Five Tips on Dealing with Cybersecurity Threats

If we've learned anything about cybersecurity over the past few years, it's that it can happen to anyone. Just ask Target and The Home Depot. But that doesn't mean we're hopeless. Here are five things that you can do toward dealing with those threats. [9/25/14]

- For Want of a Nail: Know Your Customer

When an institution loses the BSA/AML war, all too frequently it comes down to the proverbial nail of KYC. AffirmX's Ken Agle gives pointers on navigating the minutiae and winning the Know Your Customer battle. [9/24/14]

- Why the CFPB Matters Even If It Isn’t Your Regulatory Agency

Today, you can't throw a stick anywhere in the compliance news landscape without hitting at least a few items either from or about the agency that likes to refer to itself as "The Bureau." Some may disregard these reports from and about the Consumer Financial Protection Bureau, because they understand that it only directly regulates large financial institutions in excess of $10 billion. However, even if your bank or credit union is far beneath that threshold, the CFPB matters. AffirmX's Dennis Agle explains why. [9/23/15]

- Personal Cybersecurity

In these perilous cybersecurity times, Lancaster Rose Credit Union's Matt Steffy gives 10 tips for personal online or mobile banking safety. [9/22/14]

- Increasing Focus on Lending by Outsourcing Compliance Functions

With constantly changing regulations, it may be more efficient to outsource compliance functions rather than creating an extensive in-house compliance department. [9/22/14]