Links in “Compliance Tips”

- How to Prepare for Your Next RDC Audit

The flexibility and convenience of remote deposit capture makes it a tempting target for fraudsters. Here's some guidance on what you can do to prepare for your next RDC audit. [8/26/14]

- Risk Watch 26: SAFE Act Exceptions

They say thereâs an exception to every rule. In the case of the Secure and Fair Enforcement for Mortgage Licensing Act, or SAFE Act, there are actually TWO major exceptions to keep in mind, especially if yours is a smaller financial institution. In this episode, AffirmX Analyst Abner Rangel shares what those exceptions are and what potential pitfalls they present. [8/22/14]

- 5 Common Questions about the Suddenly Hot E-SIGN Act

E-SIGN is getting more attention than ever, it seems. The reason is that regulatory and technological changes are forcing the industry to find new ways of achieving compliance in a cost-effective manner, which almost always involves the use of electronic signatures or providing important documents electronically. AffirmX's Senior Analyst, Coppelia Padgett, provides five questions she's received about E-SIGN and their answers. [8/19/14]

- Are You Prepared to Manage the Compliance Risks of Social Media?

Social media is all the buzz in credit union marketing departments, but is your compliance staff prepared to manage the compliance risk associated with using this media? Many social media activities generate compliance requirements under a host of federal consumer protection statutes. This article provides a good overview of what you need to consider when establishing your internal procedures. [8/19/14]

- Protecting Your Institution Against the Next HMDA Firestorm

The proposed HMDA rules calling for far more data collection categories is a game changer that could lead to a replay of 1991, when the initial release of HMDA information ignited a firestorm of fair lending litigation. Now may be the time to run your institution's numbers using the proposed categories to see if there are disparities that should be addressed now before it starts to get toasty. [8/18/14]

- 7 âMustsâ to Ensuring Strategic Planning Success

A lot of time and expense can go into your annual strategic planning session, but are you getting the desired results? Or is it just a mini-vacation for the volunteers and senior staff? Here are seven practical steps to take to ensure you get the maximum benefit from your efforts. [8/15/14]

- When a Loan Mod Becomes a Refi

A loan modification requires minimal new disclosures, whereas a loan refinancing requires the whole ball of disclosure wax. As such, it's imperative to know when modifying the terms of an existing loan results in a modification or a refinancing. Here's some guidance on the matter. [8/14/14]

- Top 5 ACH Trouble Spots

For many people, August signals such pleasantries as football season and children returning to school. To the credit unionâs operations officer, those changes are just as likely to signal the impending deadline for the annual ACH audit. Senior Analyst Coppelia Padgett introduces some common trouble spots she's seen that may help to keep in mind, whether they conduct their own ACH audits or hire it out. [8/12/14]

- Wrangling Complaints in the Shadow of the UDAAP Beast

In an age when a customer complaint can easily slip into an unfair, deceptive or abusive act or practice (UDAAP) with the flick of an examiner's wrist, your ability to effectively track and manage complaints is paramount. [8/7/14]

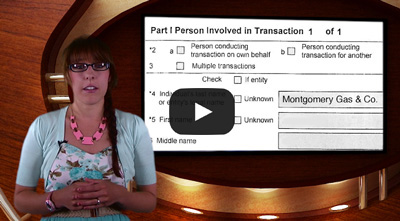

- Risk Watch 23: Seven Deadly CTR Sins

Nope, itâs not gluttony or greed! In this video, Analyst Rachel Osborn details the seven common errors she sees institutions make in their currency transactions reports. [8/1/14]