Links in “BSA/AML”

- Customer Due Diligence Is Getting More Diligent

FinCEN is proposing new rules under the Bank Secrecy Act which would put emphasis on identifying beneficial owners of legal entity customers. [8/4/14]

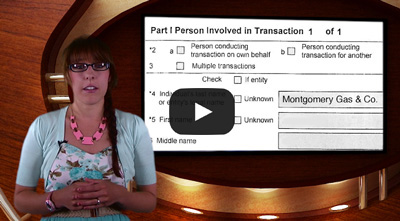

- Risk Watch 23: Seven Deadly CTR Sins

Nope, itâs not gluttony or greed! In this video, Analyst Rachel Osborn details the seven common errors she sees institutions make in their currency transactions reports. [8/1/14]

- No More Hiding for Beneficial Owners

FinCEN and the Treasury are amending the CDD requirements as part of the BSA in an effort to increase the transparency associated with the real people that own, control, and profit from the companies using banking services. [7/31/14]

- BSA/AML: Regulation by Enforcement

Bankers are reporting that the statutes and regulations no longer tell the whole story. They're having to look into the most recent enforcement action against their peers, and then try to plug those holes, as described in this aptly named post, "We Won't Tell What To Do Until After We Punish You For Not Doing It." [7/30/14]

- New York Moving Toward BitLicense

The state is proposing licensing dealers of virtual currency, including strict anti-money-laundering safeguards and consumer protections. [7/25/14]

- 3 Common Mistakes Seen in AML Validation

AdvisX President Ken Agle describes three common errors found during AML validations and what institutions should do to fix them (before and after validation). [7/22/14]

- FinCEN Raises an Eyebrow at FBME

FinCEN issues a notice of proposed rulemaking on FBME (Federal Bank of the Middle East) citing money laundering concerns as its primary issue. [7/22/14]

- Risk Watch 21: Common AML Validation Errors

The effectiveness of an institutionâs Bank Secrecy Act program hinges on the accuracy of its anti-money laundering monitoring system. AdvisXâs President Ken Agle shares three common errors he sees when conducting AML validations for financial institutions across the country. [7/18/14]

- FinCEN: the New Captain America?

FinCEN has taken action against FBME Bank Ltd, citing the foreign bank for weak anti-money laundering controls. FinCENâs director states, âthe United States will not stand by while financial institutions help those who intend to harm or threaten Americans.â [7/18/14]

- What’s the Worst that Could Happen Without Anti-Money Laundering Systems?

Well, for one thing, it might bring a civil money penalty of $45,000 as money services business Mian knows too well. The institution failed to satisfy crucial BSA/AML reporting requirements such as filing CTRs for all currency transactions exceeding $10,000. [7/16/14]