Links in “BSA/AML”

- Using Your AML System to Detect Human Trafficking

There are patterns of transactions that could suggest human trafficking and that could be detected by your AML system. If you aren't looking for them, the question may arise "How much human trafficking is being supported in your supply chain with your logo on it?" [10/8/14]

- FTC Comments on FinCEN’s Proposal

Find out what the FTC has to say about FinCEN's proposed rule regarding strengthening customer due diligence requirements. [10/8/14]

- FinCENâs Customer Due Diligence Rule Could Be Onerous for Credit Unions

FinCENâs proposed changes to its due diligence rules could increase credit unionsâ regulatory burden without providing a counterbalance of benefits. CUNA is urging FinCEN to focus on strengthening BSA/AML rules on non-financial institutions. [10/6/14]

- Big Brother Alert: FinCEN’s CDD Proposals Go Too Far

Beyond the issue of the cost vs. benefits of FinCEN's proposed customer due diligence expansion is the issue that it would provide state and federal law enforcement unfettered surveillance access to small- and medium-sized businesses in a way that exceeds U.S. corporate law requirements and supersedes congressional authority or mandate. [10/6/14]

- Money Laundering Is Not in Style for the Los Angeles Fashion District

As part of an anti-money laundering crackdown against drug cartels, FinCEN placed the Los Angeles Fashion District under a Geographic Targeting Order (GTO) requiring increased reporting and recordkeeping requirements for certain trades and businesses. [10/3/14]

- AML Climate of Fear Causing Banks to Push the Exit Button

Former Bush administration security advisor says that big penalties for AML mistakes, while effective in drawing attention, are creating a zero tolerance environment that threatens to push banks to exit whole regions and categories of businesses. [10/1/14]

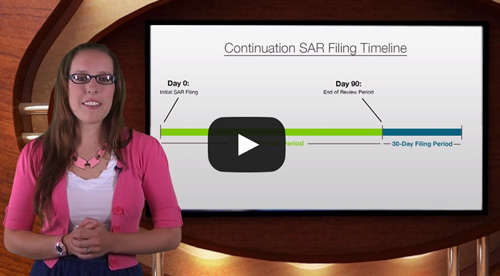

- Risk Watch 31: Continuation SAR Conundrums

When a financial institution identifies a suspicious activity related to a previously filed SAR and that activity is within a specified timeframe, it needs to file what is called a continuation SAR. The timeframe and what goes in a continuation SAR frequently trip up financial institutions. In this episode, AffirmX Analyst and SAR specialist Rachel Osborn helps us sort out these common trouble spots. [9/26/14]

- Anti-Terrorism: What You Need to Know about the Recent ATA Rulings

Earlier this week, there were two court decisions made against financial institutions for violating the Anti-Terrorism Act (ATA). Find out what they did and how you can avoid it. Hint: Record Retention and a robust AML compliance program are important. [9/25/14]

- For Want of a Nail: Know Your Customer

When an institution loses the BSA/AML war, all too frequently it comes down to the proverbial nail of KYC. AffirmX's Ken Agle gives pointers on navigating the minutiae and winning the Know Your Customer battle. [9/24/14]

- Symitar and Fiserv Are Duking It Out

The gloves are off between Symitar and Fiserv over who has the largest share of the credit union market for core operating systems. Each is publicly disputing the other's data when it comes to the number of credit union clients, retention rates, and conversion rates. [9/24/14]