Links in “BSA/AML”

- Five Essential Steps to an Examination-Ready BSA Risk Assessment

Scrutiny of Bank Secrecy Act compliance at financial institutions everywhere is surging. Fines and enforcement orders are all over the headlines. Regulators, as well as board members, want to know that banks and credit unions have taken a good look at what their exposure is, and have a solid plan in place to address those risks. What are the elements of a solid BSA Risk Assessment? [3/8/16]

- Compliance: When Your ABC’s Actually Start With SAR

Valerie Y. Moss, CUNA's senior director of compliance analysis, writes briefly about the procedures for initiating and processing a SAR, touching base on some important need-to-know information. [3/7/16]

- FATF Releases Risk-Based Guidance on Money Transfer Services

The Financial Action Task Force (FATF) released a 71-page guide on Money or Value Transfer Services (MVTS) that includes guidance to countries, authorities, participants and financial institutions in applying a risk-based approach to MVTS with an emphasis that not all MVTS providers should be categorized as high-risk. [2/24/16]

- GAO Analyzes Remittance Transfers and AML Impact

The GAO released its study on remittance transfers and impact on the rules on financial institutions as well as merits for BSA AML. The 59-page study analyzes the $586 billion flow through remittances, the challenges placed on financial institutions with respect to the efforts being considered regarding related AML practices. [2/17/16]

- How Well Do You AML/CTF?

The Financial Action Task Force recently updated their "list of jurisdiction with strategic Anti-Money Laundering and Counter-Terrorist Financing (AML/CTF) deficiencies," prompting FinCEN to issue a bulletin to urge credit unions to implement stronger AML/CTF programs for select countries. [2/10/16]

- Virtual Currency Founder Pleads Guilty to Laundering $250 Million

Liberty Reserve was a virtual currency that cybercriminals around the world used to launder more than $250 million. Its founder has pleaded guilty. [2/1/16]

- Where Exactly Does That SAR Go?

You investigate. You write your suspicious activity report. You click submit. Then what happens to your SAR? The Financial Crimes Enforcement Network, otherwise known as FinCEN, released its 2014 annual report of Suspicious Activity Report stats. It includes an overview of what happens to SARs after they are reported.

- The Dark Side of Crowdfunding: A New Favorite Tool of Money Launderers?

While the overall number of Suspicious Activity Reports associated with crowdfunding is relatively low, the Financial Crimes Enforcement Network has found that mentions of crowdfunding in SAR filings increased 171% just through the first half of 2014 compared to all of 2013. Crowdfunding has become a new favorite tool in the hands of money launderers. Here are the warning signs you should be aware of. [1/12/16]

- Do You Know NCUAâs Top Exam Priorities for 2016?

The NCUA has announced its exam priorities for 2016 and they include a continued focus on interest rate risk, the new CUSO registration, TRID compliance, and BSA complianceâparticularly as it relates to money services businesses and incident response programs. NCUA also indicated that it will be incorporating the new FFIEC cybersecurity self-assessment process into its examination priorities by the third quarter. [1/12/16]

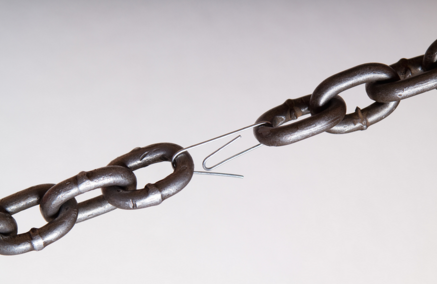

- Two Years and No SARs/CTRs? Someone May Be Eyeing You as a Weak Link

If it's been awhile since your financial institution has filed a CTR or a SAR, you may think you're flying under FinCEN's radar. If so, you may want to think again. Not only could regulators be eyeing you as a weak link, but criminals and terrorists may be targeting your institution because they assume that smaller institutions may lack the training and/or procedures to identify reportable transactions. [1/5/16]