Links in “Mortgage Lending”

- Evans Bank Redlining Case a Harbinger of Other Lawsuits?

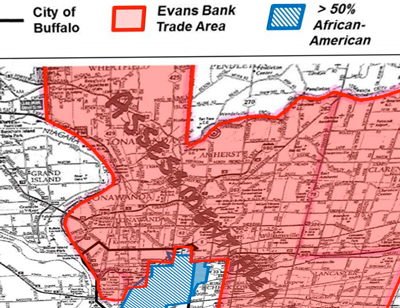

New York is taking aim at Evans Bank, alleging that the regional lender in the Buffalo area is denying mortgages in certain African-American neighborhoods regardless of applicant credit. Sources say it is a harbinger of other lawsuits that could be brought against other banks. [9/3/14]

- Pres. Obama Announces Initiative to Lower Mortgages for Members of Military

Under the initiative, announced by Pres. Obama at the American Legion's national convention, mortgage servicers will actively seek out military members eligible for lower-cost refinancing rather than waiting for them to apply. [8/27/14]

- Say Goodbye to Post-Payment Interest Charges

Mortgagees are no longer able to charge interest through the end of the month in which the mortgage was paid and must instead charge interest only through the date the mortgage was paid. [8/26/14]

- Webcast Wednesday: Examiner Expectations

NAFCU is holding a webcast on Wednesday which will outline what to expect from your upcoming examinations, focusing on the new mortgage rules. [8/25/14]

- CFPB Moves Forward with eClosings Pilot Program

The agency announces the vendors and financial institutions that will be participating in its mortgage eClosing pilot program, which is scheduled to take place later this year. [8/25/14]

- A Closer Look at New Mortgage Servicing Guidance

The CFPB's newly released guidance on mortgage servicing sets for two new sections, "General Transfer-Related Policies and Procedures" and "Applicability of the New Servicing Rules to Transfers." [8/25/14]

- Risk Watch 26: SAFE Act Exceptions

They say thereâs an exception to every rule. In the case of the Secure and Fair Enforcement for Mortgage Licensing Act, or SAFE Act, there are actually TWO major exceptions to keep in mind, especially if yours is a smaller financial institution. In this episode, AffirmX Analyst Abner Rangel shares what those exceptions are and what potential pitfalls they present. [8/22/14]

- The Elixir of Mortgage Closing?

The CFPB has announced the participants selected for its three-month eClosing pilot program. Hoping the program will "provide valuable insight" into efforts to improve the mortgage closing experience, CFPB Director Richard Cordray explained, "we believe that eClosings have the potential to create a better process for everyone involved." The selected participants include both vendors and creditors to assess the effectiveness of a variety of possible solutions to be used. [8/22/14]

- Mortgage Loan Transfers Under the Magnifying Glass

CFPB outlines expectation established for mortgage servicers. âAt every step of the process to transfer the servicing of mortgage loans, the two companies involved must put in appropriate efforts to ensure no harm to consumers. This means ahead of the transfer, during the transfer, and after the transfer,â said CFPB's Cordray. "We will not tolerate consumers getting the runaround when mortgage servicers transfer loans." [8/20/14]

- NCUA Wins Back Ability to Pursue Banks Over Deceptive MSBs

The 10th Circuit Court of Appeals has handed NCUA a victory by reinstating its ruling that allowed NCUA to sue several banks over alleged deceptive practices related to their sales of mortgage backed securities to corporate credit unions. The ruling affects six cases pending in the 10th circuit. NCUA has settled similar cases and recovered more than $1.75 billion. [8/20/14]