Links in “FTC”

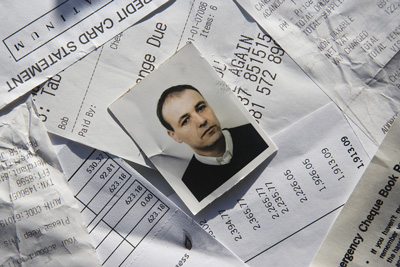

- Identity Theft: The Number One Complaint

For over a decade consumers have been wary of identity theft and with all the technology at our fingertips today, this concern is bigger than ever. The FTC has released resources in order to combat this growing concern. [10/20/14]

- CFPB Roundtable Signals Ongoing Focus on Latino Consumers

CFPB and FTC will host a roundtable on debt collection practices on Latino consumers, especially those with limited English proficiency. [10/13/14]

- FTC Comments on FinCEN’s Proposal

Find out what the FTC has to say about FinCEN's proposed rule regarding strengthening customer due diligence requirements. [10/8/14]

- FTC: Ruler of UDAP

The NCUA has repealed its regulations governing unfair or deceptive acts or practices. But donât worry, this area is still being watched over by the FTC. [10/6/14]

- FTC Collects from Abusive Debt Collectors

Pinnacle Payment Services, LLC, has been banned from debt collection activities and is subject to a settlement fee of over $9 million after engaging in abusive debt collection practices. This is one of many recent cases involving the FTC halting illegal and abusive practices related to debt collection. [9/24/14]

- FTC Cleans Up Scammers’ Mess

The FTC is mailing over $1.7 million in refund checks to consumers harmed by AmeriDebt's fraudulent activities. This credit counseling and debt management scam led 60,813 consumers to believe they would be receiving training on how to handle finances and credit, but instead left them out to dry. The refund checks being sent add to the $15 million the FTC has already sent for this scam alone. [9/19/14]

- Online Payday Lender Shut Down

A Missouri-based online payday loan company has received a temporary restraining order from the FTC due to illegal lending practices. In an 11-month period, the company issued $28 million in loans, and collected over $46.5 million. [9/18/14]

- Scheme Takes $100 Million from Bank Accounts of Online Payday Loan Shoppers

The CFPB and FTC have shut down two operations that swindled consumers who were looking for loans online and had money withdrawn from their bank accounts under false pretenses over a period of time. Victims said they couldn't stop the companies from drawing money out of their accounts. [9/18/14]

- FTC Calls Attention to Mobile Services

The FTC has responded to the CFPBâs request for information concerning the use of mobile financial systems. The FTC highlights five consumer protection issues and the risk mitigation steps that are in place to address these issues. [9/15/14]

- Repeal Regulation AA: What Do You Say?

Regulation AA is under review as the Federal Reserve Board requested comment to repeal the regulation. While this regulation would no longer fall under the Federal Reserve Board, unfair and deceptive practices would still be prohibited under the FTC and Dodd-Frank. [8/25/14]