Links in “FTC”

- FTC Studies Credit Card Data Security Auditing

The Federal Trade Commission has issued orders to nine companies that conduct payment card industry screening, requiring them to provide the agency with information on how they conduct assessments of companies to measure their compliance with Payment Card Industry Data Security Standards (PCI DSS). [3/8/16]

- FTC Recaps its Debt Collection Protection

When it comes to protecting against debt-collection abuses, the FTC wants you to know it has been busy. From filing amicus briefs, to consulting with the CFPB in connection with upcoming rulemaking, to its 18 debt collection cases (a new best), to launching 12 new enforcement actions under "Operation Collection Protection," there is much to be done in the world of shady debt-collection practices. [2/23/16]

- Bad Idea: Selling Loan Application Data to Scammers

FTC hits a group of defendants who took sensitive information from their pay-day loan websites and sold that information to entities that used the data to scam millions of dollars from the victims. [2/19/16]

- Federal Trade Commission Modifies Its Regulatory Review Schedule

The FTC reviews its rules on a ten-year basis in order to determine whether any are unduly burdensome or no longer relevant. The Commission is modifying its review schedule for 2016 through 2026. During 2016, the FTC will initiate review of the following rules: Standards for Safeguarding Customer Information, CAN-SPAM Rule, Labeling and Advertising of Home Insulation, and Disposal of Consumer Report Information and Records. [2/16/16]

- “Major Advance” in Recovering from Identity Theft

FTC will host a press conference tomorrow to announce a major step toward helping victims of identity theft. [1/25/16]

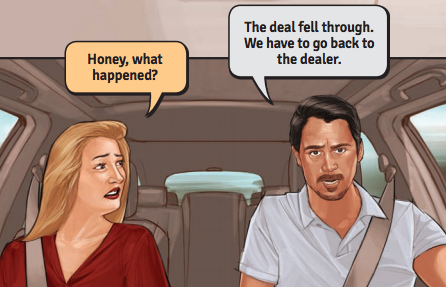

- Helping Latino Community Avoid Auto Dealer Scams Via “Fotonovela”

The FTC has released a fotonovela that tells a story of a family that buys a minivan with dealer financing, only to be told later by the dealer that the financing fell through and that, to keep the car, they have to accept a new, more expensive deal. It's part of an initiative to raise awareness of scams targeting the Latino community. [1/22/16]

- FTC Scores Hit on Payday Lenders

Two payday lenders have agreed to pay the FTC $4.4 million and to waive $68 million in loan fees to settle claims that they illegally charged inflated and undisclosed fees to consumers. In one case, the lender advertised that a $300 loan would only cost $290 to repay, when in fact borrowers paid $975. The payday lenders were also cited for Reg. Z violations for failing to accurately disclose the APR and other loan terms. [1/7/16]

- How Do You Use Big Data?

A new report from the Federal Trade Commission delves into the use of Big Data and discusses how outcomes from analysis can be used to provide benefits to underserved populations in opposition to excluding these populations from credit, healthcare, and education opportunities [1/7/16].

- Payday Lenders Pay $4.4 Million to Settle Deception Charges

The Federal Trade Commission charged two payday lenders in April of 2012, Red Cedar Services Inc. and SFS Inc, alleging that the lenders misrepresented how much loans would cost consumers, and failed to accurately disclose the annual percentage rate of other loan terms. Each company has paid $2.2 million to settle these charges, and have collectively waived $68 million in fees to consumers which were not collected as a result of these violations of the FTC Act and TILA. [1/6/16]

- FTC Issues Enforcement Policy Statement for âNativeâ Advertising

The FTC recently released an enforcement policy statement and guide regarding the general principles which the Commission considers in determining whether an ad format is deceptive and violates the FTC Act. The guide, located here, specifically addresses ânativeâ ads which look like surrounding non-advertising content, and is designed to help institutions comply with the policy statement in the context of native advertising. [12/23/15]