Links in “CFPB”

- Holes in the CFPB’s Overdraft Report

The CFPB characterized overdraft fees as "gotchas," but does not address whether heavy overdrafters are engaged in deliberate or inadvertent activity, whether they are using overdrafts as a substitute for deposit advance loans, the use of text alerts for customers whose accounts dip below pre-set levels, and more. [8/5/14]

- Complaints for All the World to See

The Federal Register is open for comments regarding a rule change that would allow the CFPB to disclose unstructured complaint narratives among other certain complaint data. [8/5/14]

- ABA to CFPB on Overdrafts: 100% of Consumers with Overdraft Protection Opted In

ABA responds to the CFPB's study on overdraft protection pointing out that everyone with overdraft protection has opted in and can opt out at anytime. [8/4/14]

- Employee Evaluation Under Evaluation

Evaluating employee performance is a good thing, right? Ever since the CFPB got slammed for employee discrimination, we arenât too sure. [8/4/14]

- New Bill Would Increase Minimum Asset Level for CU Supervision

Reactions have been mixed to a new bill that would increase the minimum asset level that triggers direct CFPB supervision over credit unions with assets from $10 billion to $50 billion. The outspoken CEO of the $28 billion State Employees Credit Union, Jim Blaine, prefers being under CFPB versus NCUA. Bill Cheney, former CUNA CEO and now CEO of the $10 billion SchoolsFirst FCU supports the bill, but noted the change would leave only Navy Federal Credit Union under CFPB supervision. Cheney recommends that direct supervision by the CFPB be eliminated for all credit unions. [8/1/14]

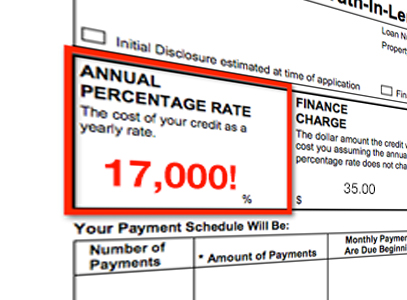

- 17,000 Ways CFPB Is Paving the Way for Overdraft Protection Overhaul

The CFPB released a report revealing the true cost of opting-in to overdraft protection for ATM and debit card transactions, which results in an APR of 17,000%, a number which has captured the media's attention (see, for example, this). Expect significant changes to overdraft protection rules to follow shortly. [8/1/14]

- Cordray: Growth Pressures Led to Employee Issues

Speaking to the House Financial Services Committee, CFPB Director Cordray blamed the pressure on quickly building the new agency for breakdowns in the working environment and review process for its employees that led to allegations of racial and gender discrimination. [8/1/14]

- How the CFPB Spends (or Doesn’t) Your Civil Money Penalties

Where do the civil money penalties imposed by the CFPB go? The Government Accountability Office reviewed the bureau's handling of the penalty fund and found that of $139 million in civil penalties collect, $31 million went to compensate victims, $13.4 million for consumer education, $1.5 million for administrative expenses, leaving $93 million in unallocated funds. [8/1/14]

- What Happens When Congress Gives the CFPB a Blank HMDA Check

When Congress passed Dodd Frank in 2010, it added 10 data elements to HMDA reporting, but it also gave the CFPB a blank check to add whatever else it determined necessary. The CFPB took that blank check, resulting in the 573-page proposal for HMDA that is now before us. [7/31/14]

- Due to Complaints, CFPB Grants 30-Day Extension of Comment Period for Complaint Narratives Proposal

Responding to industry complaints that a 30-day comment period on the proposal to add consumer complaint narratives to its complaint database, the CFPB has granted a deadline extension to 9/22/14. [7/31/14]