Links in “CFPB”

- World Acceptance Skirts Payday Loan Rules, May Be Outskirted by CFPB

World Acceptance Corporation, which extends small-dollar loans to individuals, then refinances them multiple times, has acknowledged that it is under investigation by the CFPB. Also see this earlier story on the CFPB's two-part investigation. [8/14/15]

- Citizens Bank Deposit-Processing Practice Underscores Need to Protect CFPB

Opinion piece in Esquire uses Citizens Bank "shoddy" deposit-processing practice as an example of why calls to abolish the CFPB are a mistake. [8/14/15]

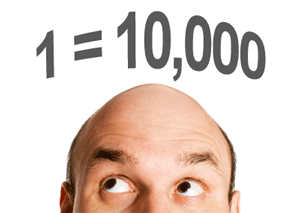

- 1=10,000: Thinking Like the CFPB

A former attorney for the CFPB provides a glimpse of how the bureau thinks. Whereas other agencies may look for a pattern or a practice before taking action against a lender, the CFPB may give a single consumer complaint the weight of 10,000. "If you point out to them that you have 3 million consumer contacts and 100 consumer complaints are statistically irrelevant they donât care. In the CFPB's mind, every single consumer matters." [8/13/15]

- Flaws Are Noted in CFPBâs Arbitration Report

The CFPB issued a report that determined that mandatory arbitration clauses harm consumers. However, George Mason University has taken that report to task by finding that its comparison of class action settlements to arbitration awards was not the appropriate methodology to use and that, in fact, consumers fare better through arbitration than through class action settlements. [8/13/15]

- Citizens Bank Fined for Keeping the Leftovers

Itâs hard to believe, but for years Citizenâs Bank had a policy that it would keep any discrepancies between the amount noted on the customerâs deposit ticket and the actual amount of the deposit based on the total of the cash and checks for small transactions. Over the years those small discrepancies amounted to about $11 million dollars in additional revenue to the bank. Now the CFPB says, âGive it back!â [8/13/15]

- Citizens Bank Hat Trick

- “Sloppy Banking” Costs Citizens $34.5 Million

The "unfair and deceptive" practice of sometimes pocketing the difference when there was a discrepancy between the size of the deposit and the number written on the deposit slips will cost Citizens Bank $14 million in restitution and $20.5 million in federal penalties. "This is sloppy banking," said CFPB Director Richard Cordray. [8/13/15]

- Study: CFPB’s Intention to Regulate Arbitration Agreements is a Terrible Idea

The CFPB's own study is flawed, but even its own findings show arbitration works. [8/12/15]

- Is it the End of World?

World Acceptance Corporation, one of the largest consumer finance companies in the country, has plunged 22% in its shares. The cause of this drop is due to the CFPB, who may be taking legal action against World. [8/11/15]

- Periodic Statements Under Proposed Bankruptcy Rules Could Get Expensive

Under new bankruptcy rules proposed by the CFPB, the periodic statement could become substantially more costly to management and deliver. [8/10/15]