Links in “CFPB”

- CFPB’s Cordray Addresses CAB on Arbitration Clause Restriction Efforts

CFPB Director Richard Cordray's addresses a meeting of the Consumer Advisory Board (CAB) focusing on the CFPB's efforts to curtail arbitration clauses, which are seen as negatively impacting consumer's rights to seek action against companies who often use them to block class action lawsuits and sidestepping the legal system. [10/23/15]

- Not So Fast, CFPB: There Are Limits to Its Authority to Regulate Arbitration Agreements

While experts are debating whether the Federal Arbitration Act would need to be amended to permit the CFPB to ban class action waivers in arbitration agreements, this expert says Section 1028 already places several important limitations on the CFPB's authority. [10/22/15]

- CFPB Proposed Rule Could Cause Credit Unions to End Up in Court More Often

That is the concern being expressed by some in response to the CFPBâs proposed ban to class action waivers in arbitration clauses. The end result of the ban could be more days spent in court, an increase in compliance costs, and an elimination of certain products and services. [10/22/15]

- Vendor Sluggishness Used to be Just Bad Business. Now? Watch Out.

Just how far does the CFPB's reach go? "Some vendors performed poorly in getting their work done in a timely manner," said the CFPB's director. "It may well be that all of the financial regulators, including the consumer bureau, need to devote greater attention to the unsatisfactory performance of these vendors." [10/22/15]

- Warren on CFPB: If It Ain’t Broke…

Writing in the Huffington Post, Sen. Elizabeth Warren (D-Mass.) claims the efforts to replace the CFPB's director with a commission miss the point: the CFPB has been effective in accomplishing what it was established to do. [10/21/15]

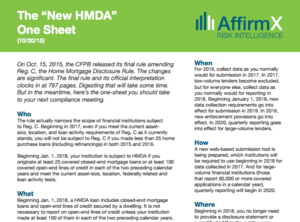

- The One-Sheet on the New HMDA Rule You Should Take to Your Next Compliance Meeting

On Oct. 15, 2015, the CFPB released its final rule amending Reg. C, the Home Mortgage Disclosure Rule. The changes are significant. The final rule and its official interpretation clocks in at 797 pages. Digesting that will take some time. But in the meantime, here's the one-sheet you should take to your next compliance meeting. Download it here. [10/20/15]

- Cordray Fires Warning Shot Across Vendor Bow Re: TRID

Amid reports that some vendors were creating obstacles for lenders attempting to comply with the TILA-RESPA Integrated Disclosure rule, CFPB Director Cordray said financial regulators "need to devote greater attention to the unsatisfactory performance of these vendors." [10/20/15]

- Credit Unions to CFPB on Overdraft Protection: Remember, We’re Not Like Banks

CUNA meets with the CFPB to remind the bureau as it considers revising overdraft protection that credit unions are far different from banks, offering these services as a convenience and accommodation for their members, who appreciate these services. [10/19/15]

- Risk Watch 74: RESPA Compliance and Marketing Service Agreements

The risks associated with Marketing Service Agreements may have just spiked, a spike we can attribute to a recent CFPB compliance bulletin. AffirmXâs Mike Stottlemyer helps decipher the warnings found in the bulletin. [10/16/15]

- CFPB Adopts Final Rule To Expand HMDA Data Collection

The changes to Regulation C that implement the Home Mortgage Disclosure Act will require credit unions and other financial institutions to collect more data on a larger scope of mortgage loan products, including home equity lines of credit. The credit union trades associations had lobbied hard to have credit unions excluded from the burdensome expanded data collection requirements, but the CFPB did not choose to go in that direction. [10/16/15]