Links in “Home Mortgage Disclosure Act (HMDA)”

- CFPB Requests Comments Regarding HMDA Information Collection

HMDA requires collection and reporting of information about mortgage loan originations and purchases. Information collection helps CFPB determine whether institutions are complying with HMDA's various provisions. CFPB has invited comments regarding the utility and burden of information collection. [11/10/15]

- Bracing for the CFPB’s Next Big Wave: HMDA

When it comes to new HMDA requirements, two years to get compliant may sound like a long time. But coming so closely on the heels of the TRID changeover has many lenders reeling. (See Risk Watch 76Â for a video overview.) [11/3/15]

- Risk Watch 76: Why the âNewâ HMDA is a Big Deal

The CFPB has released an 800-page overhaul of the Home Mortgage Disclosure Act, and the changes are rather significant. How should you prepare? Barrett Jones, head of data analytics for AdvisX, breaks down what changes financial institutions should know about and, more importantly, what they mean. [10/30/15]

- Top Worry? TRID Compliance

86% of banks say their top regulatory challenge is complying with the new TILA-RESPA Integrated Disclosure rule. Not far behind are the new reporting requirements for HMDA. (See Risk Watch 76 for an overview of the "new" HMDA.) [10/30/15]

- Regulation C Amendments

Final modifications to Regulation C are being published by the CFPB. These amendments seek to define the types of institutions and transactions subject to the regulation, the data which is required to be collected by institutions, and the reporting and disclosing processes for such data. [10/28/15]

- New HMDA Rule Requires Reporting of Many New Data Points

The Dodd-Frank Act required that the CFPB collect 17 pieces of data on the Loan Application Register (LAR). In its new HMDA rule, the CFPB decided to add 16 more data points to that list of items to be tracked and collected. Take a look here at the new comprehensive list. [10/26/15]

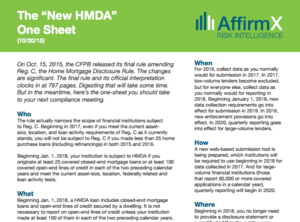

- The One-Sheet on the New HMDA Rule You Should Take to Your Next Compliance Meeting

On Oct. 15, 2015, the CFPB released its final rule amending Reg. C, the Home Mortgage Disclosure Rule. The changes are significant. The final rule and its official interpretation clocks in at 797 pages. Digesting that will take some time. But in the meantime, here's the one-sheet you should take to your next compliance meeting. Download it here. [10/20/15]

- Is New HMDA Applicable to Your CU?

It's a bit convoluted and will take some time to unravel, but here's what we know so far. [10/19/15]

- CFPB Adopts Final Rule To Expand HMDA Data Collection

The changes to Regulation C that implement the Home Mortgage Disclosure Act will require credit unions and other financial institutions to collect more data on a larger scope of mortgage loan products, including home equity lines of credit. The credit union trades associations had lobbied hard to have credit unions excluded from the burdensome expanded data collection requirements, but the CFPB did not choose to go in that direction. [10/16/15]

- Industry on New HMDA: Ouch

While what the CFPB had previously proposed would've been worse, the "new HMDA," with 25 new data points and 14 modified data points in addition to the existing 9 data fields already required under HMDA, "adds to the excessive burden for many community banks, which will further restrict access to credit in local communities." [10/16/15]