Links in “FDIC”

- FDIC’s September Enforcements

FDIC issued 36 enforcement orders in September, including 10 removal and prohibition orders. [11/2/15]

- The FDIC Sets the Designated Reserve Ratio for 2016

The Board of Directors of the FDIC has set the Designated Reserve Ratio for the Deposit Insurance Fund at 2% for 2016. Â [10/27/15]

- One Less Regulation! FDIC Eliminates Electronic Operations

As a result of the Dodd-Frank Act, the Electronic Operations regulation was transferred from the Office of Thrift Supervision to the FDIC in July of 2011. The FDICÂ has determined that this regulation is unnecessary and burdensome and therefore has elected to rescind it. Â [10/27/15]

- FDIC Looks to Meet Deposit Reserve Required Levels

The FDIC is looking to increase the Deposit Insurance Fund (DIF) to the statutorily required minimum level of 1.35 percent from the 6/30/2015 level of 1.06 by imposing assessments on larger banks with a fully funded date estimate of 2017. [10/23/15]

- TRID or Treat

October doesn't just bring Halloween this year, but the long anticipated TILA-RESPA Integrated Disclosure rule (TRID). Following in the CFPBâs footsteps, the FDIC has provided guidance of its own in connection with the new rule and how initial examinations for compliance with this rule will be handled. [10/5/15]

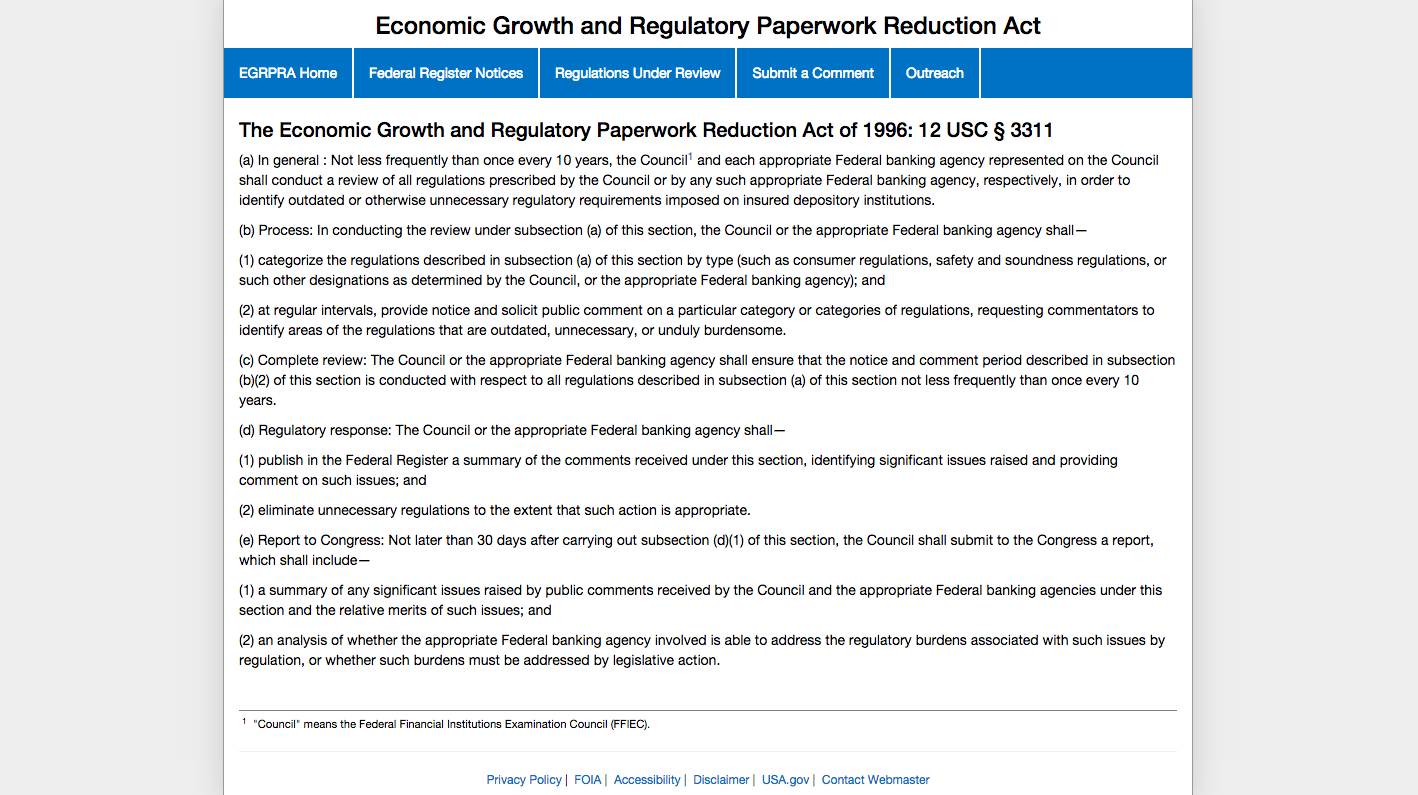

- The FRB, FDIC and OCC Have Invited You to Nit-Pick Their Regulations. Seriously.

On Oct. 19, 2015, the FDIC, the OCC, and the FRB will conduct an outreach meeting regarding the Economic Growth and Regulatory Paperwork Reduction Act of 1996 (EGRPRA). The act's purpose is to root out unnecessary regulation. The meeting will be webcast live and viewers will have an opportunity to share their comments on agency rules using a text chat feature. [9/29/15]

- Federal Reserve System to Sponsor Fair Lending Webinar

On October 15, 2015, the Federal Reserve System will host a fair lending webinar. Participating agencies will include NCUA, CFPB, the FDIC, the OCC, the DOJ, the Federal Reserve Board, and the Department of Housing and Urban Development. A wide range of subjects will be discussed, including developments in mortgage lending, compliance management, pricing, and the use of data to evaluate fair lending risk. [9/29/15]

- Putting the Force in Enforcement

The FDIC has released its August enforcement actions, which consists of 27 actions taken. [9/28/15]

- FDIC Not Involved in Operation Choke Point (Mostly)

The agency's inspector general's investigation finds that the FDIC's involvement in Operation Choke Point was "inconsequential." However, it did find evidence that some FDIC officials, including regional directors in Chicago and Atlanta, had sent communications to banks reflecting negatively on payday lenders that were not consistent with the FDIC's written policy and guidance. [9/18/15]

- FDIC Hits Comenity for UDAAP Violations

The FDIC hit Comenity Bank and Comenity Capital Bank $64 million in CMPs and restitution requirements for UDAAP related violations associated with deceptive practices in the Bank's marketing and servicing of credit card "add-on products." Comenity promotes co-branded credit cards through various retailers nationwide and cross promotes payment protection/debt cancellation add-on products to these cards. Key violations included practices on fees related to add-ons, material misrepresentations and omissions on product cancellations and gift cards. [9/11/15]