Links in “Credit Unions”

- SBA 7(a) Program Hits Statutory Limit; Lending is Suspended

The SBA 7(a) small business loan program has reached its statutory limit for this fiscal year. Officials at the SBA said that pending applications will proceed through the final approval stage, but that funding will be suspended until the new fiscal year begins on October 1st or until Congress acts to extend the statutory ceiling. [7/28/15]

- NCUA Holding Town Hall Webinar Today

NCUA Chair Debbie Matz may be on the firing line for recent comments she made to a Congressional subcommittee when she hosts another free town hall webinar today at 3:00 pm (EST). Scheduled topics include NCUAâs regulatory modernization and regulatory relief efforts and the state of the industry. [7/28/15]

- NASCUS Calls For Scrutiny of OTR Docs

NASCUS President/CEO Lucy Ito wants to know why the NCUA never made public a section of a 2011 Price Waterhouse report that recommended that the Agency consider feedback from stakeholders on how it classifies its insurance related and operational activities for the purpose of determining the overhead transfer rate (OTR). The NCUA posted its OTR documentation on its website last Friday. [7/28/15]

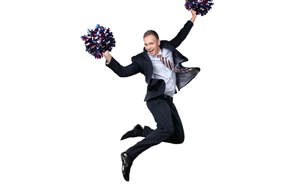

- Cheerleader? Bankers Press for NCUA Investigation

As a result of comments made by NCUA Chair Debbie Matz at a recent Congressional hearing, bankers are urging Congress to investigate whether the NCUA is truly operating as an independent regulatory agency. The bankers claim that NCUA is simply a âcheerleaderâ for credit unions that allows credit unions to circumvent legislative action on issues such as the member business lending cap through favorable regulations. [7/27/15]

- Are Smart Watches a Ticking Time Bomb?

A report just released by HP Fortify indicates the answer is âyes.â The company reported that 100% of the smartwatches it tested contained significant network and communication vulnerabilities including poor authentication, lack of encryption, and privacy issues. [7/27/15]

- Matz Backpedals on Hearing Comments

NCUA Chair Debbie Matz is attempting to make amends by issuing a prepared statement explaining her comments at a House subcommittee hearing that credit unions donât represent their members. While not apologizing directly for her comments, Matz did apologize if her comments were construed as indicating that she lacked faith in credit union management. [7/27/15]

- The Controversy Continues Over Compensating Board Members

Oregon has just become the 16th state in the country to allow its state-chartered credit unions to elect to compensate their board of directors. The Michigan Credit Union League, however, recently dropped its support for a similar measure in its state. [7/23/15]

- Why a Compliance Culture is So Important

Providing compliance training and written policies and procedures is not always enough to ensure that your staff doesnât commit compliance violations. An effective compliance culture embeds compliance into every business decision and member interaction in which your staff members are involved. [7/23/15]

- SBA 7(a) Lending Programs Could Be Temporarily Suspended

Due to a 20% increase in small business lending, the Small Business Association announced that its popular 7(a) small business lending program may reach its statutory limit before the end of the fiscal year. If this occurs, the SBA would have to suspend lending under the program until the beginning of the new fiscal year on October 1st. [7/23/15]

- Fixed Asset Rule and the Budget on Todayâs NCUA Board Agenda

At todayâs meeting the NCUA Board will vote on a final rule that will eliminate the 5% cap on federal credit unionsâ investments in fixed assets. The Board will also perform a mid-year reprogramming of its annual budget. [7/23/15]