Links in “Credit Unions”

- Partial Victory for CUs That Make FHA Loans

The FHA has announced a partial withdrawal of its proposal to establish a maximum timeline to file an FHA insurance claim, which could have placed significant burdens on credit unions with foreclosed properties. The FHA still plans to move forward with provisions that curtail interest and disallow certain expenses incurred by lenders that fail to initiate foreclosure actions in a timely manner. [10/21/15]

- Fannie Mae Innovations Should Save Time, Costs

In mid-2016, Fannie Mae lenders will be required to begin using trended data when underwriting single-family borrowers through Desktop Underwriter. Trended data will allow lenders to access monthly payment amounts over time. Other innovations will include new functionalities for underwriting borrowers without traditional credit histories, single sign-on capabilitie, and the ability to verify income directly through Desktop Underwriter. [10/21/15]

- Southeastern, NY Leagues Agree to Nationâs Largest Collaboration Project

The League of Southeastern Credit Unions and the New York Credit Union Association announced they have signed a Letter of Intent to form a company to consolidate their back office operations and other non-state specific functions. It is believed that over the first three years of operation the joint venture will save each league millions of dollars. [10/21/15]

- New Report Slams ChexSystems and Early Warning System

A report from the National Consumer Law Center and Cities for Financial Empowerment accuses the consumer reporting agencies (CRAs) like ChexSystem and Early Warning System of preventing millions of Americans from obtaining banking services. The report authors claim that the CRAs often mistakenly identify the victims of identity theft or scams as the perpetrators of the fraud, which causes financial institutions to deny their new account requests. The report also states that the CRAs use inconsistent definitions of what constitutes fraud, account abuse, and other negative events, including when to report them. [10/21/15]

- NCUA Is Sponsoring Open-Forum Meeting at Alexandria Headquarters

Registration is now open to credit union stakeholders for an in-person meeting with Debbie Matz at the NCUA headquarters in Alexandria, VA. The free, open-forum session will be held on Friday, October 30th at 10:00 am EST and, because of capacity restrictions, will be limited to the first 100 registrants. [10/20/15]

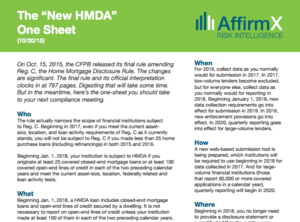

- The One-Sheet on the New HMDA Rule You Should Take to Your Next Compliance Meeting

On Oct. 15, 2015, the CFPB released its final rule amending Reg. C, the Home Mortgage Disclosure Rule. The changes are significant. The final rule and its official interpretation clocks in at 797 pages. Digesting that will take some time. But in the meantime, here's the one-sheet you should take to your next compliance meeting. Download it here. [10/20/15]

- NCUA Had a Good Day

Yesterday, NCUA accepted settlements from two more banks for their roles in the sales of faulty residential mortgage-backed securities to corporate credit unions. Although not admitting fault, Barclayâs Capital agreed to pay NCUA $325 million to settle claims and Wachovia Bank agreed to a payment of $53 million. This brings the amount collected by NCUA from banks that participated in the events that led to the liquidation of several corporate credit unions to a total of $2.2 billion. [10/20/15]

- Southeastern League Votes to Give Members a Choice

There appears to be a sort of rebellion in the ranks as another credit union league has voted to give its members a choice of membership. The Board of the League of Southeastern Credit Unions, which serves credit unions in Florida and Alabama, voted unanimously to give its members the choice of joining the League without also having to join CUNA. The League CEO says that he remains a strong CUNA supporter, but believes that offering a membership choice is in the best interests of their credit unions. [10/20/15]

- Is New HMDA Applicable to Your CU?

It's a bit convoluted and will take some time to unravel, but here's what we know so far. [10/19/15]

- Credit Unions to CFPB on Overdraft Protection: Remember, We’re Not Like Banks

CUNA meets with the CFPB to remind the bureau as it considers revising overdraft protection that credit unions are far different from banks, offering these services as a convenience and accommodation for their members, who appreciate these services. [10/19/15]