Links in “Credit Unions”

- 3 out of 4 Employees Embezzling Funds

Okay, okay, so your credit union is probably not suffering from a 75% employee embezzlement rate. However, the statistic is true for an Oahu-based credit union; three of only four employees were simultaneously, but separately, embezzling a total of $500,000 over the course of the years. [5/6]

- US House Back in Session

The House is back in session and can commence its review of several CUNA-backed bills designed to relieve the regulatory burden of credit unions. [5/6]

- Negating Retaliation Against Whistleblowers

The Equal Employment Opportunity Commission reports that the total number of complaints for all categories has dropped, except one: employees reporting employer retaliation. It is important for your credit union employees to feel safe reporting suspicious activity not just from members, but from fellow employees. CUNA Mutual Group provides three safeguards against retaliation. [5/6]

- Time to Add a Compliance Advocate?

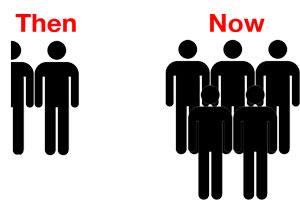

In late 2012, this Tennessee CU had 1.5 people dedicated to compliance and BSA. Now it has five dedicated employees, plus two who work in legal. One employee is called the compliance advocate. [5/5]

- A Look at the So-Called “Minor” Changes to Mortgage Rules

Here's why the CFPB's self-described "minor" changes to mortgage rules may not be so minor after all. [5/5]

- The Gist of the CFPB’s Fair Lending Report

A brief recap of the CFPB's Fair Lending Report, including guidance on how lenders may self-assess their own compliance with ECOA and HMDA. [5/5]

- Reg Relief Bills Up for Consideration Next Week

Three bills that would provide regulatory relief for credit unions are scheduled for consideration next week in the House. The three bills address extending the share insurance coverage to all underlying owners in IOLTA and similar accounts, expanding credit unionsâ ability to apply for Federal Home Loan Bank membership, and granting credit unions and other lenders more say in the CFPBâs rural-area designations. [5/2]

- Urgent-Needs Grants Available Through NCUA

NCUA has issued a reminder to low-income credit unions in the South and Midwest that they can apply for emergency grants through their Urgent Needs Initiative. The grants, which can be in amounts up to $7,500, are to cover emergency expenses resulting from the recent natural disasters in those areas. [5/2]

- NCUA Board Says No to RBC Extension Request

In a letter to CUNA, NCUA Board member Rick Metsger echoed the decision of Debbie Matz that there will be no extension of the comment period of the proposed Risk-Based Capital rule. Metsger stated that he feels there is sufficient time remaining in the comment period, which ends on May 28th, for all interested parties to submit their comments. [5/2]

- NCUA Receives Approval to Intervene in Loan Participation Lawsuit

NCUA has received approval to intervene in a lawsuit against three former employees of the now-liquidated Lynrocten Federal Credit Union. The $1.6 million dollar suit filed by Northern Piedmont Federal Credit Union alleges the three employees engaged in a loan participation fraud scheme. [5/2]