Links in “Credit Unions”

- NCUA Awards $1 Million Plus in Grants to Low-Income Credit Unions

NCUA has awarded 204 grants to 174 low-income credit unions for a total expenditure of $1,051,850. NCUA had received 331 requests for grants this year for everything from funds for training to new products and services to fund application requests to the U.S. Department of the Treasury for approval to become a Community Development Financial Institution. [8/4/14]

- If You Snooze, You May Lose

It appears that a majority of credit unions are going to miss the October 15, 2015 deadline to equip their credit cards with EMV chips. This could be very costly as credit cards without EMV chips will not be eligible for liability relief from credit card losses after that deadline. [8/4/14]

- Privately Insured Credit Union Fails

Bensenville Community Credit Union, with $14 million in assets and 2,200 members, was closed by Illinois state regulators. The credit union was privately insured by American Share Insurance. [8/4/14]

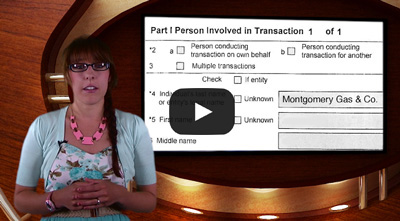

- Risk Watch 23: Seven Deadly CTR Sins

Nope, itâs not gluttony or greed! In this video, Analyst Rachel Osborn details the seven common errors she sees institutions make in their currency transactions reports. [8/1/14]

- NCUA Says No Future Corporate Assessments Are Expected

NCUA staff members say the credit unions should not anticipate any future assessments as a result of the corporate credit union failures. However, the agency said that itâs too early to talk about any refunds to credit unions. [8/1/14]

- New Bill Would Increase Minimum Asset Level for CU Supervision

Reactions have been mixed to a new bill that would increase the minimum asset level that triggers direct CFPB supervision over credit unions with assets from $10 billion to $50 billion. The outspoken CEO of the $28 billion State Employees Credit Union, Jim Blaine, prefers being under CFPB versus NCUA. Bill Cheney, former CUNA CEO and now CEO of the $10 billion SchoolsFirst FCU supports the bill, but noted the change would leave only Navy Federal Credit Union under CFPB supervision. Cheney recommends that direct supervision by the CFPB be eliminated for all credit unions. [8/1/14]

- NCUA Approves Proposed Easing of Fixed Asset Rule

At yesterdayâs meeting the NCUA Board approved a proposed rule that would the eliminate the 5% fixed asset cap on existing assets for federal credit unions. Going forward federal credit unions would be permitted to exceed the 5% cap provided they have implemented a fixed asset management program. [8/1/14]

- Industry Lends Support to Cybersecurity Legislation

Many trade groups join together to lend support to CISA, the Cybersecurity Information Sharing Act, legislation designed to promote prompt information sharing on cyber threats between businesses and the government. [8/1/14]

- NCUA Releases Economic Update Video

The video that includes an in-depth discussion with NCUA Chief Economist John Worth highlights the improving labor market, falling unemployment rates, and the positive effect this is having on loan demand and delinquency rates. Mr. Worth also discusses how these changes may affect a credit unionâs balance sheet and the interest rate environment. [7/31/14]

- Banks Causing HAMP Backlog

Large mortgage servicers have caused a huge backlog in mortgage modifications requests by not processing Home Affordable Modification Program (HAMP) applications in a timely manner. Ocwen Loan Servicing has the largest backlog with 61,000 pending HAMP applications. Sun Trust Mortgage recently paid $320 million to settle a claim that it misled consumers about how long its modification process would take. [7/31/14]