Links in “Credit Unions”

- A Hello to ARMs

Tim Mislansky (chief lending officer at Wright-Pratt Credit Union Inc.) and Tracy Ashfield (CEO of Ashfield and Associates) have observed that adjustable rate mortgages offer better rates to those consumers who do not plan to reside in a property for more than 10 years. The trick, according to Mislansky, is to help the member avoid the "knee-jerk" negative reaction to the offer of an ARM. [9/17/14]

- NCUA Discourages Bullying of Underdog

NCUA's Director of the Office of Examination and Insurance, Larry Fazio, testified at the Senate Banking Committee meeting Tuesday on behalf of small credit unions. His intentions mirror the overall efforts of NCUA to provide regulatory relief and streamline examinations for smaller institutions while offering assistance in whatever manner possible. [9/17/14]

- Welcome to the Neighborhood: Did Apple Just Become a Regulated Financial Institution?

With its launch of Apple Pay, a mobile payments service, did Apple just make itself subject to regulation under the Consumer Financial Protection Act? Some experts think so. [9/17/14]

- Data Security Weak Link: Mobile Apps

Research indicates that 75% of mobile apps will fail basic security tests through 2015 and that the focus of breaches will move from desktops to smartphones and tablets by 2017. [9/17/14]

- Five Keys to a Strong Complaint Management Program

Complaint management used to be so simple. Perhaps your institution looks back fondly on the days when complaints were usually over the phone about a billing issue. But in this day and age, customers, members, and even employees have a cornucopia of complaint outlets, such as Facebook, Yelp, the CFPB's complaint database, or even your own website. Thatâs why every institution needs an effective response system. Here are five key points to assist financial institutions in accomplishing this task. [9/16/14]

- Topic of the Day: Regulatory Burden

The regulatory burden on credit unions is the topic of three separate articles today. The first discusses Linda McFadden's testimony to the Senate Banking Committee why "enough is enough" regarding overregulation of credit unions. The second relates to the same hearing, but focuses on CUNA's testimony that will hopefully be "an important step toward preparing...bills for Senate consideration." The third features another testimony by CUNA, this time to the FHFA about how safety and soundness do not justify overregulation. [9/16/14]

- Current Expected Credit Losses (CECL) Gets a Makeover (and Five Steps to Success)

The process for accounting for loan loss is currently undergoing changes that could be implemented in 2017. Director of special projects for MainStreet Technologies gives credit unions five steps for success in complying with these changes. [9/16/14]

- Social Media: Nothing Is off the Record

Part of sound social media training for employees is making sure they know that they are always representatives of their bank and should therefore not share anything they wouldn't want their employer or customers to see. Here are four other recommendations for social media training. [9/16/14]

- So You Want to Start a Federal Credit Union?

The NCUA lays out five parts of the process in its new resource offering information on applying for a federal credit union charter. [9/16/14]

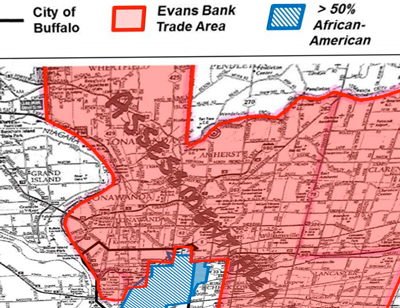

- Lessons from Redlining for Credit Unions

There is a lot for credit unions to learn in light of recent redlining developments according to AffirmX's Jane Pannier, despite the fact that redlining has traditionally been a bank issue. [9/15/14]