Links in “Credit Unions”

- Pentagon Aims to Tighten Lending Loopholes

Proposed rules would broaden the definition of consumer credit so more loans to servicemembers and their dependents would be subject to interest rate caps. [9/29/14]

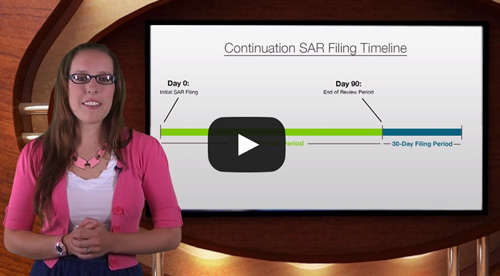

- Risk Watch 31: Continuation SAR Conundrums

When a financial institution identifies a suspicious activity related to a previously filed SAR and that activity is within a specified timeframe, it needs to file what is called a continuation SAR. The timeframe and what goes in a continuation SAR frequently trip up financial institutions. In this episode, AffirmX Analyst and SAR specialist Rachel Osborn helps us sort out these common trouble spots. [9/26/14]

- TILA-RESPA: What to Do “Between Now and Then”

NAFCU is offering advice to the credit union unsure of what to do between now and the implementation of the TILA-RESPA rule, which is still nearly a year away. [9/26/14]

- How to Double Your Social Media Impact

The trick? Hide $50 every day for members to find and put the clues on your Facebook page. That's what Great Lakes Credit Union did which allowed them to achieve their "objective of building an even closer bond with [the] area" and get some local media coverage to boot. [9/26/14]

- Economic Forecast from CUNA

CUNA economist are now offering a new tool to help credit unions understand the current and upcoming economic climate, and how changes might affect the way credit unions deal with their members. [9/26/14]

- Walmart Won’t Steal Your Members

The senior financial analyst at Bankrate.com provides some encouraging words for credit unions who fear competition from Walmart, which will be offering a checking account product. When you have a product with overdraft fees, minimum balance, or monthly fees, it will likely "appeal to consumers who...can't get or don't want a checking account at either credit unions or traditional banks." [9/26/14]

- Risk-Based Capital Not Set in Stone

NCUA Chair Debbie Matz, in response to a letter from Rep. George Holding, said that she is "fully committed to making changes and clarifications to the proposed rule, where warranted." Holding also questioned the NCUA's authority to make such a rule; others are vying for a second comment period. Where do you stand? [9/26/14]

- Car Starter Interrupter: Privacy Intrusion or Smart Collection Strategy

A customer falls behind on a car payment, you turn on an app on your cell phone, see that the customer is parked at a mall, press a button, and immediately disable the car. Suddenly you get a call from your customer seeking to make a payment. This collection practice in operation now is considered by some to be a smart collection move, by others to be Wall Street's version of Big Brother. [9/26/14]

- More Data Means More Public and Regulatory Scrutiny

The proposed HMDA rule that calls for a significant increase in the amount and type of mortgage data that covered lenders will be required to report and the proposed expansion to the CFPBâs consumer complaint website mean that both the public and your regulatory agency will have much more information about your financial institution. Is that a good thing? [9/25/14]

- Two Credit Unions File Suit Against Home Depot

Southern Chautauqua FCU in Lakewood, NY ($61 million in assets) and First Choice FCU in New Castle, PA ($39 million in assets) filed suit last week against Home Depot for damages they incurred as a result of the massive data breach. In the suit, the credit unions assert that Home Depot knew about the breach before they made the situation known to the public. [9/25/14]