Links in “Banks”

- Risk Watch 65: The Question Game of Compliance

When it comes to regulatory compliance, what are the best ways to gauge the health of your institutionâs regulatory program? Asking the right questions is always a good place to start. So what are the main kinds of questions compliance experts get asked? And what are the questions experts suggest you should be asking? [8/14/15]

- Efforts to Expand Housing Market to Minorities and First-Time Borrowers Proving Difficult

Half a year after lowering mortgage insurance premiums in an effort to entice more minorities and first-time buyers into the housing market, a report shows no movement for the two groups compared to a year earlier. [8/14/15]

- World Acceptance Skirts Payday Loan Rules, May Be Outskirted by CFPB

World Acceptance Corporation, which extends small-dollar loans to individuals, then refinances them multiple times, has acknowledged that it is under investigation by the CFPB. Also see this earlier story on the CFPB's two-part investigation. [8/14/15]

- Citizens Bank Deposit-Processing Practice Underscores Need to Protect CFPB

Opinion piece in Esquire uses Citizens Bank "shoddy" deposit-processing practice as an example of why calls to abolish the CFPB are a mistake. [8/14/15]

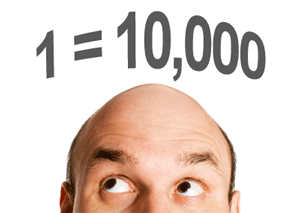

- 1=10,000: Thinking Like the CFPB

A former attorney for the CFPB provides a glimpse of how the bureau thinks. Whereas other agencies may look for a pattern or a practice before taking action against a lender, the CFPB may give a single consumer complaint the weight of 10,000. "If you point out to them that you have 3 million consumer contacts and 100 consumer complaints are statistically irrelevant they donât care. In the CFPB's mind, every single consumer matters." [8/13/15]

- An Appeal for the FFIEC to Get Specific on TRID Transition Enforcement

ABA writes to the members of the FFIEC to request that it articulate its policy for examining financial institutions during the initial months after TILA-RESPA Integration Disclosure Rules take effect. [8/13/15]

- TRID Casualty: Wells Fargo Says Bye-Bye to Closed-End Home Equity Loans

Rather than retool its closed-end home equity loan disclosures to meet new TILA-RESPA Integrated Disclosure requirements, Wells Fargo has stopped offering such loans. The company will shift its focus to its non-TRID home equity lines. [8/13/15]

- “Sloppy Banking” Costs Citizens $34.5 Million

The "unfair and deceptive" practice of sometimes pocketing the difference when there was a discrepancy between the size of the deposit and the number written on the deposit slips will cost Citizens Bank $14 million in restitution and $20.5 million in federal penalties. "This is sloppy banking," said CFPB Director Richard Cordray. [8/13/15]

- Data from Online Payday Loan Applications Used to Pilfer Accounts

Two Florida companies have been charged by the FTC for illegally selling the data of consumers completing their online payday loan applications to companies who subsequently raided the applicants' bank accounts for at least $7.1 million. [8/13/15]

- Despite Concerns, Internet Banking Remains Top Dog

An ABA survey finds that online banking is still the most popular banking method. Continuing its rapid rise is mobile banking, preferred by 12% of consumers, up from 3% just five years ago. [8/12/15]