Links in “Banks”

- Three Monkeys Approach to ATA Ill-Advised

A circuit court decision suggests that playing blind, deaf and dumb is not a viable business strategy when it comes to the Anti-Terrorism Act. Violations go beyond just knowing that an account is supporting terrorist activities to include knowledge or deliberate indifference that it is supporting a terrorist organization. [9/29/14]

- Pentagon Aims to Tighten Lending Loopholes

Proposed rules would broaden the definition of consumer credit so more loans to servicemembers and their dependents would be subject to interest rate caps. [9/29/14]

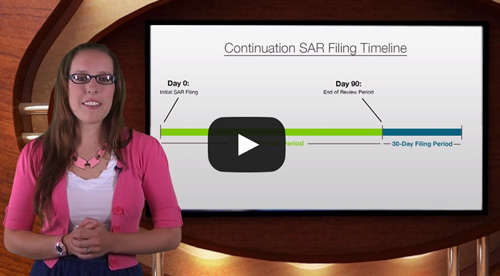

- Risk Watch 31: Continuation SAR Conundrums

When a financial institution identifies a suspicious activity related to a previously filed SAR and that activity is within a specified timeframe, it needs to file what is called a continuation SAR. The timeframe and what goes in a continuation SAR frequently trip up financial institutions. In this episode, AffirmX Analyst and SAR specialist Rachel Osborn helps us sort out these common trouble spots. [9/26/14]

- Unheeded Warnings Cause Unneeded Fines

After charging consumers for add-on features that were never provided, U.S. Bank is required to pay $48 million in relief to customers, $4 million to the OCC, and $5 million to the CFPB. Richard Cordray, CFPB Director, was absolutely unapologetic, saying "we have consistently warned companies about [these] practices..." [9/26/14]

- Car Starter Interrupter: Privacy Intrusion or Smart Collection Strategy

A customer falls behind on a car payment, you turn on an app on your cell phone, see that the customer is parked at a mall, press a button, and immediately disable the car. Suddenly you get a call from your customer seeking to make a payment. This collection practice in operation now is considered by some to be a smart collection move, by others to be Wall Street's version of Big Brother. [9/26/14]

- If Walmart Wants to Act Like a Bank, It Should be Regulated Like a Bank

ICBA reacts to Walmart's announcement that it will soon offer checking accounts by issuing a statement calling for the retail giant to be subject to the same legal and regulatory framework, consumer protections and oversight as traditional checking accounts offered by banks. [9/26/14]

- Credit Card Add-On Products Land U.S. Bank in Hot Water

U.S. Bank will pay $48 million in relief to customers and $9 million in penalties to the CFPB and OCC for issues related to the practices of its third-party vendor, Affinion, in handling credit card add-on services. [9/26/14]

- More Data Means More Public and Regulatory Scrutiny

The proposed HMDA rule that calls for a significant increase in the amount and type of mortgage data that covered lenders will be required to report and the proposed expansion to the CFPBâs consumer complaint website mean that both the public and your regulatory agency will have much more information about your financial institution. Is that a good thing? [9/25/14]

- News Groups: Complaint Narrative Proposal Doesn’t Go Far Enough

News groups submit that CFPB proposal that would require consumers to consent to public disclosure of their complaint narrative should be removed, because the complaints are already subject to disclosure under FOIA. [9/25/14]

- If CFPB Really Wants to Protect Student Borrowers, It Should Start with Federal Student Loans

While private student lenders have been feeling the heat lately, this trade group points out that the federal student loan default rate is 13.7%, compared to less than 3% for private student loans. [9/25/14]