Links in “Discriminatory Practices/Disparate Impact”

- Falsely Advertising Mortgage Refinancing for Free? That Will Be $500,000, Please

Delta Prime Refinance will settle for a whopping $500,000 in order to settle FTC charges regarding deceptively advertising mortgage refinancing as âfreeâ, among other things. [9/15/14]

- Disparate Impact Update

An update on two insurance industry lawsuits regarding HUD's disparate impact rule and their potential impact on financial institutions. [9/12/14]

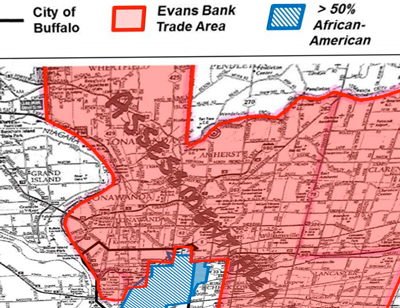

- Evans Bank Redlining Case a Harbinger of Other Lawsuits?

New York is taking aim at Evans Bank, alleging that the regional lender in the Buffalo area is denying mortgages in certain African-American neighborhoods regardless of applicant credit. Sources say it is a harbinger of other lawsuits that could be brought against other banks. [9/3/14]

- Protecting Those Who Protect Our Nation

The CFPB shut down operations of USA Discounters Ltd, which Director Cordray describes as a company that, "was designed to exploit unsuspecting servicemembers." The company sold certain financial protections that are inherently provided under the SCRA to active servicemembers. Cordray described this company's actions as "unconscionable" and said he will not allow it to continue. [8/15/14]

- HUD Settles with NJ Mortgage Company on Disability Discrimination

A New Jersey mortgage company settled with the HUD for $104,000 over discriminatory lending practices against people with a medical disability. The company required, among other things, 69 disabled applicants to provide doctorâs notes or letters from the Social Security Administration that their disability income would continue for three years. [8/14/14]

- Asking Applicants about Disabilities Costs Fifth Third $1.5 Million

Justice Department settles with Fifth Third Mortgage Co. to resolve allegations that it asked loan applicants to provide a letter from their doctor to document the income they received from Social Security Disability Insurance. [8/8/14]

- DOJ Targets Subprime Auto Lending

In collaboration with the CFPB, the Department of Justice is going after abuses in the subprime auto lending market. The DOJ has subpoenaed records dating from 2007 from General Motors concerning the securitization of its subprime auto loans. This follows on the heels of an $80 million settlement of a discrimination claim against Ally Bank in its subprime auto lending program. [8/6/14]

- Employee Evaluation Under Evaluation

Evaluating employee performance is a good thing, right? Ever since the CFPB got slammed for employee discrimination, we arenât too sure. [8/4/14]

- Cordray: Growth Pressures Led to Employee Issues

Speaking to the House Financial Services Committee, CFPB Director Cordray blamed the pressure on quickly building the new agency for breakdowns in the working environment and review process for its employees that led to allegations of racial and gender discrimination. [8/1/14]

- Casual Conversations with Members Can Lead to Discrimination Claims

Does your staff understand that a seemingly casual conversation with a member could potentially lead to a claim of discrimination? The example provided in this article has likely occurred in your credit union.