Links in “Discriminatory Practices/Disparate Impact”

- Risk Watch 35: Four Lessons from Recent Discrimination Enforcement Actions

Based on recent compliance news, regulatory scrutiny for discrimination is on the rise, resulting in enforcement action after enforcement action. Join AffirmX Analyst Henry Miles in this video as he reviews the mistakes of others, a far less painful way to learn. [10/24/14]

- Justice from the Department of Justice

The Department of Justice filed a lawsuit against Twin Oaks Mobile Home Park for refusing to rent or sell homes to families with children. Justice has been served. [10/20/14]

- Lending Discrimination Against Women on Maternity Leave: Wells Fargo Edition

The HUD announced a $5 million settlement with Wells Fargo, continuing the recent trend of going after lenders discriminating against pregnant women and women on maternity leave. [10/10/14]

- Supreme Court to Address Disparate Impact

Financial institutions have long had concerns about the use of disparate impact to prove discriminatory practices. Disparate impact does not require showing intent on the part of the institution, just statistical data that shows that a policy, practice, or action resulted in a disproportionately adverse effect on a protected class. The Supreme Court has agreed to hear the case regarding the Texas Department of Housing and Community Affairs' low-income housing policies. [10/9/14]

- Supreme Court and Disparate Impact: Third Time’s the Charm?

U.S. Supreme Court may have its third opportunity to rule on the issue of whether disparate impact claims can be considered part of the Fair Housing Act. Two previous cases were settled before the court could rule. The case could also impact disparate impact claims under the Equal Credit Opportunity Act. [10/3/14]

- Auto Lenders Underwhelmed by CFPB’s Report

Auto lenders find the CFPB's guidance on its methods for identifying discrimination in auto loans lacking. [9/19/14]

- CFPB Stands in Servicemembers’ Corner

The CFPB's "Tell Your Story" program highlights a servicemember who was targeted by a deceptive auto lending program and decided to take a stand. An investigation into the situation resulted in enforcement action against the lender in 2013, and required the lender to refund nearly $6.5 million to over 50,000 servicemembers. [9/17/14]

- No-no: U.S. Bank’s Reservations about Lending on the Reservation

U.S. Bank agrees to waive couple's $11,500 credit card balance and refinance their home after getting into hot water with the Fair Housing Act by declining to recognize their home as sufficient collateral because it was located on a reservation. [9/17/14]

- Native American Settles with US Bank

US Bank learned the hard way that discrimination against Native Americans in lending doesnât pay. In fact, it resulted in paying $11,490 as part of a settlement. [9/16/14]

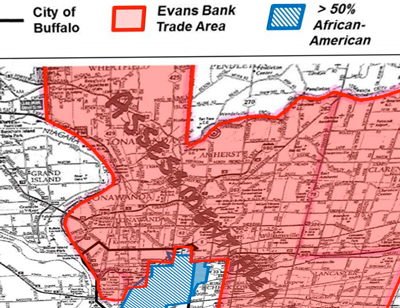

- Lessons from Redlining for Credit Unions

There is a lot for credit unions to learn in light of recent redlining developments according to AffirmX's Jane Pannier, despite the fact that redlining has traditionally been a bank issue. [9/15/14]