Links in “Discriminatory Practices/Disparate Impact”

- Toyota Disagrees with Disparate Impact Methodology, Settles Anyway

After settling with the CFPB and Department of Justice, Toyota Motor Credit Corporation issues a statement that it "respectfully disagrees" with the agencies' disparate impact methodologies to determine whether industry lending practices have been discriminatory. The methodologies included using the Bayesian Improved Surname Geocoding proxy methodology to find that African-American and/or Pacific Islanders were charged higher dealer markups than similarly situated white buyers. [2/9/16]

- Combustible Ingredients: Big Data, CFPB and Disparate Impact

The use of big data in making credit decisions may present fair lending issues if its use causes disparate impact, according to this CFPB official. [2/5/16]

- Delving Into the CFPB’s “Unreasonable” Ally Bank Methodologies

A House report finds that the CFPB's methodologies of identifying minority borrowers harmed by Ally Bank and subject to compensation were dubious. One group of 200,000 borrowers was sent a notice explaining that they would receive remuneration unless they opted out. Another group of 200,000 borrowers received letters telling them they had to opt in if they wanted remuneration. Less than 1% opted out of the first group. Nearly half the respondents opted into the second group. [2/3/16]

- Dealer Spread Favored Non-Minority Borrowers: CFPB

Over the life of a loan, the discretionary spread that Toyota dealers applied to loans ended up costing African-American borrowers $200 more and Asian borrowers $100 more than their white, similarly situated non-minority counterparts. That doesn't make the CFPB happy. Toyota is looking at $22 million in restitution and implementing new caps on dealer markups. [2/3/16]

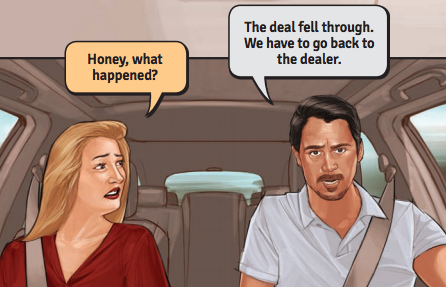

- Helping Latino Community Avoid Auto Dealer Scams Via “Fotonovela”

The FTC has released a fotonovela that tells a story of a family that buys a minivan with dealer financing, only to be told later by the dealer that the financing fell through and that, to keep the car, they have to accept a new, more expensive deal. It's part of an initiative to raise awareness of scams targeting the Latino community. [1/22/16]

- CFPB Erroneously Sending Settlement Checks to White Borrowers

Last year, Ally Financial and the CFPB reached a settlement on claims that Ally engaged in racial discrimination against African-American, Hispanic and Asian borrowers. However, a report just released by the House Financial Services Committee says that the CFPB erred in the methodology it used to identify the recipients of settlement checks and some checks were sent to white borrowers, as well. [1/21/16]

- HUD Comes Down on Foreclosure Rescue Companies for Scamming Hispanic Homeowners

HUD is charging three California-based home loan modification companies for violations of the Fair Housing Act, through targeting Hispanic homeowners for unfair loan audit and modification assistance. HUD alleges that the companies lured Hispanic homeowners into paying thousands of dollars for home loan audits which homeowners never received, as well as modification services with little to no value. Details of HUDâs charge are located here. [1/13/16]

- FHA Violations Couched as Protecting Children From Lead-Based Paint Hazards

HUD has settled with a Massachusetts real estate company for discriminating against families with children. Agents for the company discouraged families with children from applying by citing concerns that the units might contain lead-based paint. [12/22/15]

- Pricing Discrepancies Land Sage Bank in Hot Water

The Massachusetts bank charged African-American home borrowers $2,500 more for their loan and Hispanic borrowers about $1,400 more than white borrowers. The bank will pay $1.2 million in compensation, plus change its practices. [12/2/15]

- Requiring Note from Doctor Before Making a Loan: Bad Idea

Michigan lender requested an applicant for a mortgage loan get a note from his doctor proving his disability is permanent. HUD and the lender have just settled the case. "A person's qualifications to purchase a home should be the only criteria used to evaluate his or her loan application, not whether they are living with a disability." [11/18/15]