Links in “Complaints”

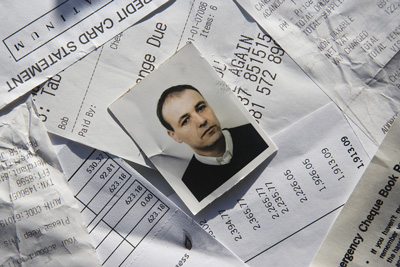

- Identity Theft: The Number One Complaint

For over a decade consumers have been wary of identity theft and with all the technology at our fingertips today, this concern is bigger than ever. The FTC has released resources in order to combat this growing concern. [10/20/14]

- Todayâs Agenda: More Complaints

As if you didnât have enough to deal with already, the CFPB has compiled a report which highlights private student loan borrower complaints. Cordray has issued a call that lenders and servicers âredouble their efforts to deal with these distressed borrowers.â [10/17/14]

- News Groups: Complaint Narrative Proposal Doesn’t Go Far Enough

News groups submit that CFPB proposal that would require consumers to consent to public disclosure of their complaint narrative should be removed, because the complaints are already subject to disclosure under FOIA. [9/25/14]

- NASCUS Complains about CFPB’s Complaint Narrative Proposal

Find out what the National Association of State Credit Union Supervisors has to say about the CFPB's proposal to expand the publicly available complaint data to include unstructured complaint narratives. Overall, NASCUS points out that potential complications and burdens may outweigh the expected benefits of the proposed change. [9/24/14]

- Trade Group: Why Adding Complaint Narratives Is a Bad Idea

CBA writes to CFPB outlining five reasons why adding consumer narratives to the CFPB complaint portal is a bad idea. [9/24/14]

- CUNA Cites Accuracy Concerns with CFPBâs Consumer Narrative Proposal

In a letter to the CFPB, CUNA expresses concern about the reputational harm that credit unions could face as a result of permitting consumers to post narrative descriptions of their complaints that could contain âinaccuracies, exaggerations and even intentionally false information.â In addition, CUNA points out that privacy concerns may not allow credit unions to provide the details necessary to adequately respond to a consumerâs complaint. [9/23/14]

- Don’t Expect CFPB to Back Down from Expansion Plans for Complaint Database

Industry observer suspects that CFPB sees its mandate going beyond UDAAP and into "improving customer service." [9/19/14]

- Consumer Complaint Narratives: Don’t Forget to Comment

CUNA would like to remind credit unions that their comments on the proposed consumer complaint narratives are needed by September 22. Make your voice heard. [9/18/14]

- Five Keys to a Strong Complaint Management Program

Complaint management used to be so simple. Perhaps your institution looks back fondly on the days when complaints were usually over the phone about a billing issue. But in this day and age, customers, members, and even employees have a cornucopia of complaint outlets, such as Facebook, Yelp, the CFPB's complaint database, or even your own website. Thatâs why every institution needs an effective response system. Here are five key points to assist financial institutions in accomplishing this task. [9/16/14]

- Saving Student Veterans

The CFPB is joining in with other departments to protect servicemembers, veterans, and their family members who are attending college. A signed agreement establishes the framework for sharing complaints; making fraud, deception, and misleading information known; and formalizing a student complaint system. [8/27/14]