Links in “Agencies”

- Op-Ed: New Way For Americans To Save

Treasury Deputy Secretary Sarah Bloom Raskin, via The Atlanta Journal-Constitution, writes about how the Treasury Department is making saving for retirement more accessible through âmy Retirement Accountâ, or myRA. This program removes many of the common barriers to saving, including fees and minimum requirements. [1/27/16]

- NACHA to Host Webinar Regarding Same Day ACH

NACHA will host a webinar on January 27 to discuss the Same Day ACH rule, which goes into effect on September 23, and other proposals regarding faster payments. [1/26/16]

- Leodan Privatbank AG and Justice Department Reach Agreement

Through the Swiss Bank Program, some Swiss banks that faced the prospect of criminal liability in the U.S. informed the Justice Department of potential tax-related criminal offenses that pertained to undeclared U.S.-related accounts. As a result of this program, Leodan Privatbank AG and the Justice Department have entered into a non-prosecution agreement. [1/26/16]

- February 1 Begins Credit Union Service Organization Registration

Pursuant to National Credit Union Administration rules, federally insured credit unions must see to it that CUSO's they lend to or invest in provide information to NCUA. To introduce the CUSO registry, NCUA also will conduct a webinar on February 11. [1/26/16]

- “Major Advance” in Recovering from Identity Theft

FTC will host a press conference tomorrow to announce a major step toward helping victims of identity theft. [1/25/16]

- No Lender Too Small to Fly Beneath CFPB’s Radar

Auto dealer in Colorado offered financing to about 1,000 people each year. Despite the small volume, it attracted CFPB's attention. Here are the unfair, deceptive, or abusive acts or practices that caught the bureau's eye. [1/25/16]

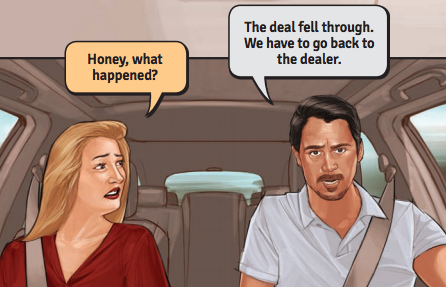

- Helping Latino Community Avoid Auto Dealer Scams Via “Fotonovela”

The FTC has released a fotonovela that tells a story of a family that buys a minivan with dealer financing, only to be told later by the dealer that the financing fell through and that, to keep the car, they have to accept a new, more expensive deal. It's part of an initiative to raise awareness of scams targeting the Latino community. [1/22/16]

- OCC: Hunker Down for Jonas

The OCC has authorized its banks affected by Winter Storm Jonas to close, but only those offices directly affected by extreme weather. [1/22/16]

- CDFI Certification Just Got Easier for CUs

Treasury and the NCUA just signed an agreement to ease the application process for low-income credit unions to become certificated as Community Development Financial Institutions. [1/22/16]

- Like How You’re Assessed for Deposit Insurance? Here’s Your Chance to Speak Out

Banks with less than $10 billion in assets that have been insured by the FDIC for at least five years would have the way their risk-based assessment are calculated under this proposed rule. Here's your chance to comment on it. [1/22/16]