Links in “Agencies”

- Washingtonians Encouraged to Obtain Flood Insurance

The amount of vegetation destroyed by wildfires in eastern and central Washington has resulted in an increased flash flood risk, and residents within affected areas are being urged by the Federal Emergency Management Agency (FEMA) to obtain flood insurance in order to protect their homes from loss. [9/30/15]

- The Public Weighs In On Student Loan Servicing

The CFPB has made available a review of public comments and recommendations regarding student loan servicing in an effort to strengthen industry practices. The report is located here. [9/30/15]

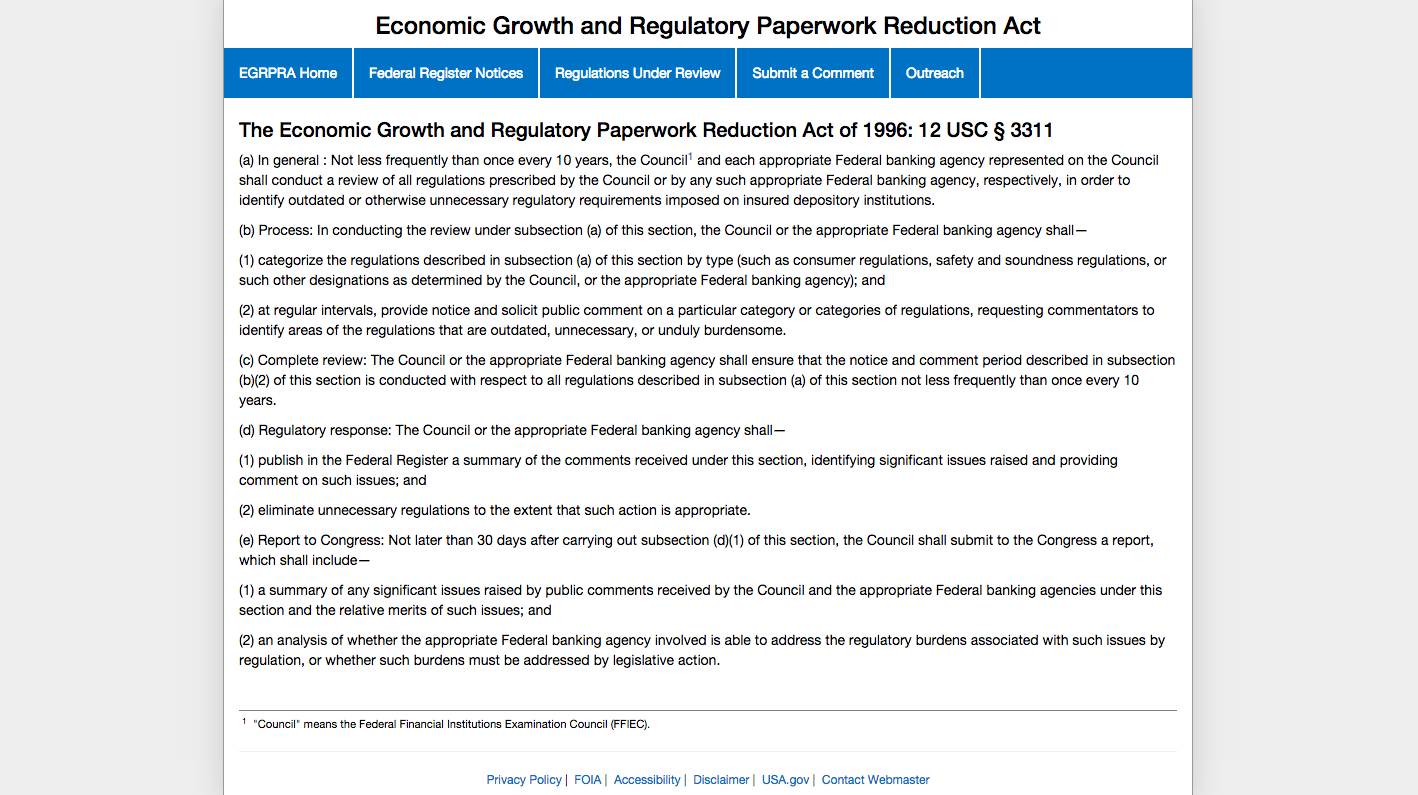

- The FRB, FDIC and OCC Have Invited You to Nit-Pick Their Regulations. Seriously.

On Oct. 19, 2015, the FDIC, the OCC, and the FRB will conduct an outreach meeting regarding the Economic Growth and Regulatory Paperwork Reduction Act of 1996 (EGRPRA). The act's purpose is to root out unnecessary regulation. The meeting will be webcast live and viewers will have an opportunity to share their comments on agency rules using a text chat feature. [9/29/15]

- Pursuant to New Rules for the Federal Reserve Banks’ Automated Clearing House Services, RDFIs Must Participate and ODFIs Will Pay a Fee

Pursuant to new rules for Federal Reserve Banks' same-day automated clearing house services, participation by receiving depository financial institutions will be mandatory. Also, originating depository financial institutions will pay an interbank fee for each forward transaction. [9/29/15]

- Federal Reserve System to Sponsor Fair Lending Webinar

On October 15, 2015, the Federal Reserve System will host a fair lending webinar. Participating agencies will include NCUA, CFPB, the FDIC, the OCC, the DOJ, the Federal Reserve Board, and the Department of Housing and Urban Development. A wide range of subjects will be discussed, including developments in mortgage lending, compliance management, pricing, and the use of data to evaluate fair lending risk. [9/29/15]

- Auto-Lending Discrimination and Illegal Credit Card Practices Prove Costly for Prominent Regional Bank

Fifth Third Bank, which operates roughly 1,300 branches in twelve states, is the subject of joint enforcement actions by the Department of Justice and the CFPB. As a result of an auto-lending enforcement action that rose from an Equal Credit Opportunity Act examination, the bank will pay $18 million to minority status borrowers and revise its pricing and compensation systems to protect against discrimination. In addition, due to an action for deceptive marketing of credit card add-on products, it will pay approximately $3 million to aggrieved customers and incur a $500,000 penalty.   [9/29/15]

- Putting the Force in Enforcement

The FDIC has released its August enforcement actions, which consists of 27 actions taken. [9/28/15]

- Hudson City Savings Bank Hit with Redlining Charge

The CFPB with the Department of Justice (DOJ) announced a joint action against Hudson City Savings Bank for discriminatory redlining practices that denied residents in majority-Black-and-Hispanic neighborhoods fair access to mortgage loans in neighborhoods in New York, New Jersey, Connecticut, and Pennsylvania. The proposed consent order, if upheld, will mandate $25 million in direct loan subsidies, $2.25 million in community programs and outreach, and a $5.5 million penalty. [9/25/15]

- SWCCU Shuttered

The NCUA announced the sixth credit union in 2015 to liquidate. This time it was SWC Credit Union chartered in 1941 with assets of $1.9 million and 309 members historically based on employees and various concessionaires of Sears, Roebuck & Company and located in various counties of Florida. [9/25/15]

- Loan Estimate Tool: The New Kid on the Block

How important is it that consumers know before they owe? According to the CFPB, pretty important. The CFPB's newest tool revolves around understanding loan estimates and is readily available to any and all consumers. [9/24/15]