Links in “FinCEN”

- Judge Slams FinCEN and DOJ on Marijuana-Related Guidance

A judge finds FinCEN and Department of Justice guidance that prosecutors and bank regulators might "look the other way" if financial institutions violate federal laws on marijuana-related businesses as "untenable." [1/11/16]

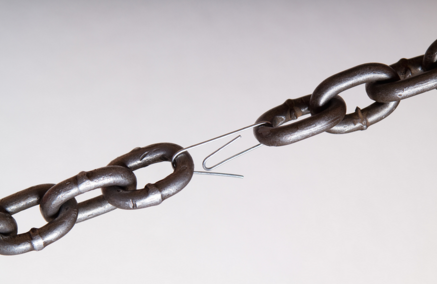

- Two Years and No SARs/CTRs? Someone May Be Eyeing You as a Weak Link

If it's been awhile since your financial institution has filed a CTR or a SAR, you may think you're flying under FinCEN's radar. If so, you may want to think again. Not only could regulators be eyeing you as a weak link, but criminals and terrorists may be targeting your institution because they assume that smaller institutions may lack the training and/or procedures to identify reportable transactions. [1/5/16]

- FinCEN Reports Receiving 55,000 BSA Reports Each Day

FinCEN receives on average 55,000 BSA reports from more than 80,000 financial institutions and 500,000 individual foreign bank account holders each day. If you think that means your CTRs and SARs are getting lost in the pile, FinCEN reports that it also receives an average of 30,000 information search requests from 9,000 different law enforcement agencies on a daily basis. [12/14/15]

- U.S., China Sign Deal on AML Framework

FinCEN signs a memorandum of understanding with its counterpart in China. The arrangement provides a mechanism for sharing information on money laundering and terrorist financing. [12/14/15]

- Compliance Culture Scoreboard: How Does Your Institution Rate?

When regulators discuss the root causes of the problems in a financial institutionâs Bank Secrecy Act and Anti-Money Laundering programs, invariably the cause that comes out at the top of their list is a weak culture of compliance. These points come from an advisory by FinCEN, the Financial Crimes Enforcement Network. The regulatory agencies have found that poor BSA performance is as much about the culture of a financial institution as it is about the products, services, customers, and geographic location of the business. How does your compliance culture measure up? Give your financial institution an honest assessment of how well it measures up in each of the six areas. [12/1/15]

- FinCEN Renews Miami GTO

FinCEN has renewed its geographic targeting order (GTO) for electronics exporters near Miami, Florida. This will require these types of exporters to implement enhanced reporting and recordkeeping for another 180 days. [10/26/15]

- Two Foreign Banks Sue FinCEN for Section 311

Used to playing offense, FinCEN finds itself on the defense against two foreign banks that are fighting back against being designated under Section 311 of the USA PATRIOT Act as "primary money-laundering concerns." [10/19/15]

- FinCEN Reports Huge Rise in Funnel Accounts

According to FinCEN, the standout trend in 2014 SAR filings was the large increase in the use of funnel accounts for money laundering purposes. A funnel account is an account that receives multiple cash deposits, often in amounts below the cash-reporting threshold, and from which funds are withdrawn in a different geographic area with little time between deposits and withdrawals. [10/15/15]

- The Top 3 Money Laundering Concerns of 2015

The fight against money laundering and terrorist financing in the U.S. is an ongoing and evolving battle. Thatâs why every year FinCEN produces a new National Money Laundering Risk Assessment from the Department of the Treasury. In an analysis of more than 5,000 law enforcement cases and financial reports from both the private and government sectors, the 2015 Risk Assessment exposes trouble spots and emerging trends all financial institutions should analyze. Financial institutions are put in a vulnerable position when individuals and entities attempt to disguise the nature, purpose, or ownership of their accounts. This can occur through several avenues, but weâll address the top three. [10/6/15]

- Risk Watch 72: Why Arenât Credit Unions Filing CTRs or SARs?

FinCENâs directer pulled the public eye when she announced data that showed many small credit unions have not filed any Bank Secrecy Act-mandated Suspicious Activity Reports or Currency Transaction Reports in nearly two years. AdvisX regulatory affairs counsel, Chris McCullock, explains what this finding means, and discusses a plausible explanation for such a lack of SAR and CTR reports. [10/2/15]