Links in “OCC”

- Increasing Credit Risks Making Comptroller Skittish

OCC's Curry talked about increasing credit risks to the federal banking system with the Risk Management Association. [11/2/15]

- The Comptroller of Currency Claims Climb in Credit Risk

Comptroller of Currency Thomas J. Curry recently spoke before the Exchequer Club. This speech focused on the recent increase in credit risk in the federal banking system. The Comptroller praised financial institutions that avoided high-risk loan products. [10/22/15]

- Three Ways the OCC Wants to Reduce Your Regulatory Burden

Making more small banks eligible for the 18-month exam cycle, a community bank exemption from the Volcker Rule, and greater flexibility for small banks to expand their business model are three ways the Comptroller has espoused to reduce regulatory burden for small banks. [10/21/15]

- OCC Pledges to Take a Closer Look at Regulatory Build-up

Comptroller of the Currency acknowledges that regulations by nature carry at least some burden, but that the benefits should outweigh the burden. He pledges that the OCC will look for areas where the regulatory rulebook has built up over time to create layer upon layer of burden for small banks. [10/20/15]

- OCC Enforcement Actions

OCC hands down two civil money penalties, two formal agreements, and three removals/prohibition orders. On the plus side, three entities saw their enforcement actions terminated. [10/19/15]

- Rescission of OCC and OTS Issuances

Following the finalization of the new regulatory capital rule, which was published by the Office of the Comptroller of the Currency (OCC) and went into effect in January of 2015, the OCC is rescinding certain bulletins and Office of Thrift Supervision (OTS) issuances which are now superseded. A list of OCC bulletins and OTS issuances which have been rescinded can be found in Appendix A, located here. [10/14/15]

- OCC Releases CRA Performance Ratings

The OCC released its list of Community Reinvestment Act (CRA) performance evaluations for September for 22 covered institutions with five rated outstanding, 17 satisfactory and none rated needs to improve or substantial noncompliance. [10/2/15]

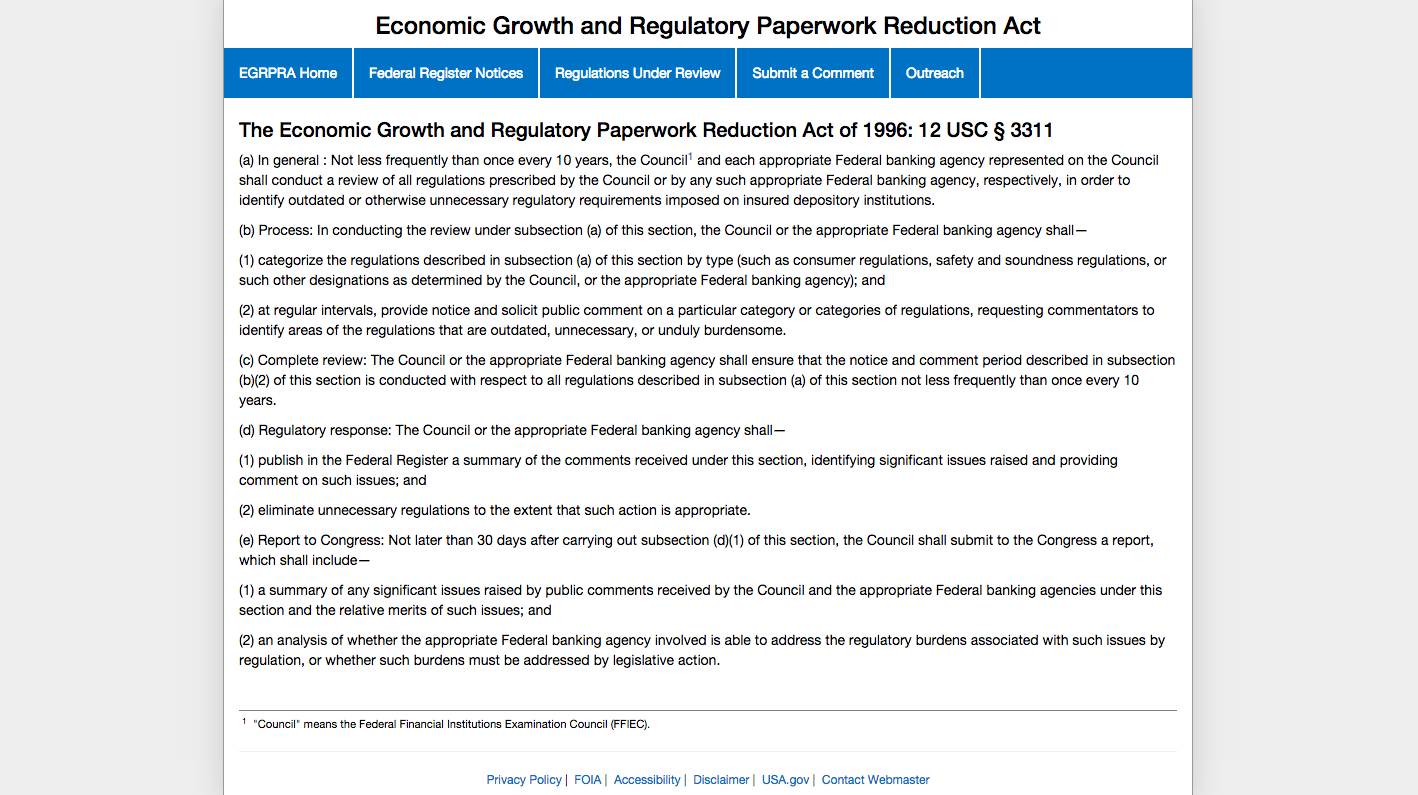

- The FRB, FDIC and OCC Have Invited You to Nit-Pick Their Regulations. Seriously.

On Oct. 19, 2015, the FDIC, the OCC, and the FRB will conduct an outreach meeting regarding the Economic Growth and Regulatory Paperwork Reduction Act of 1996 (EGRPRA). The act's purpose is to root out unnecessary regulation. The meeting will be webcast live and viewers will have an opportunity to share their comments on agency rules using a text chat feature. [9/29/15]

- Federal Reserve System to Sponsor Fair Lending Webinar

On October 15, 2015, the Federal Reserve System will host a fair lending webinar. Participating agencies will include NCUA, CFPB, the FDIC, the OCC, the DOJ, the Federal Reserve Board, and the Department of Housing and Urban Development. A wide range of subjects will be discussed, including developments in mortgage lending, compliance management, pricing, and the use of data to evaluate fair lending risk. [9/29/15]

- CRA Post-Mortem: Three Lessons from Lemont

In August 2015, the OCC announced Community Reinvestment Act performance evaluations for 30 national banks and federal savings associations. Of those evaluations 5 were rated outstanding and 24 were found satisfactory; however, one bank was rated âsubstantial noncompliance." What can other banks learn from Lemont National Bank's missteps? [9/15/15]