Links in “Federal Reserve”

- Fed Raises Reg D Reserve Tranche Limits

The Federal Reserve Board is raising the top of the low-reserve tranche (the amount of net transactions subject to the 3% reserve requirement) from $103.6 million to $110.1 million for 2016. In addition, the limit for the amount of net transactions that will be exempt from Reg. D reserve requirements will increase from $14.5 million to $15.2 million. [11/13/15]

- Federal Reserve Board Releases Enforcement Actions

Federal Reserve board executes an enforcement action on Bank of Nova Scotia and denies the request to withdraw notice of prohibition from an individual affiliated with Credit Suisse. [11/12/15]

- Raise Gas Tax to Pay for Roads? Not in an Election Year; Congress Eyes Fed’s Dividend

Congress is looking for ways to pay for more roads. Rather than raise the gasoline tax, and thereby enraging consumers in an election year, they are looking at grabbing some of the Federal Reserve's annual dividend payments to bank. [11/9/15]

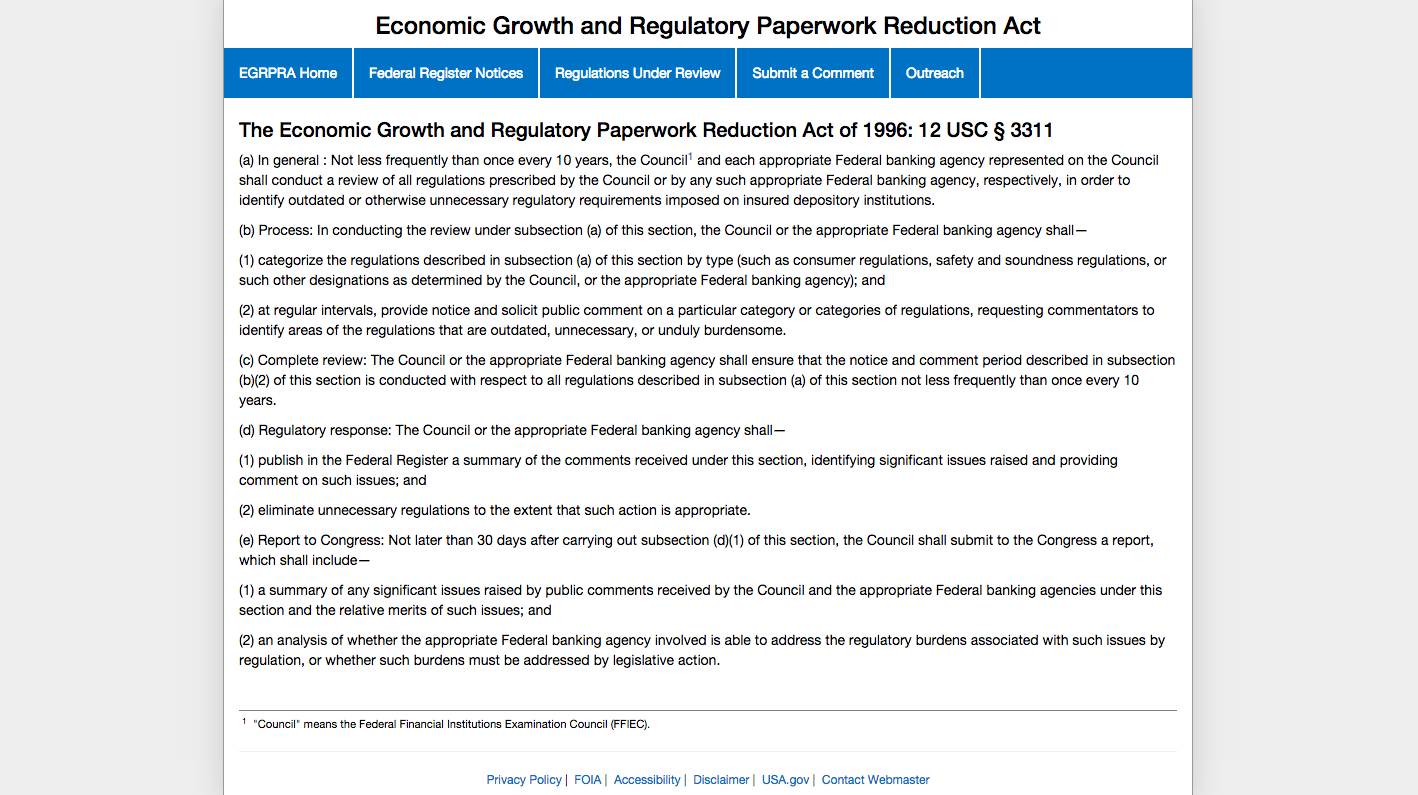

- The FRB, FDIC and OCC Have Invited You to Nit-Pick Their Regulations. Seriously.

On Oct. 19, 2015, the FDIC, the OCC, and the FRB will conduct an outreach meeting regarding the Economic Growth and Regulatory Paperwork Reduction Act of 1996 (EGRPRA). The act's purpose is to root out unnecessary regulation. The meeting will be webcast live and viewers will have an opportunity to share their comments on agency rules using a text chat feature. [9/29/15]

- Pursuant to New Rules for the Federal Reserve Banks’ Automated Clearing House Services, RDFIs Must Participate and ODFIs Will Pay a Fee

Pursuant to new rules for Federal Reserve Banks' same-day automated clearing house services, participation by receiving depository financial institutions will be mandatory. Also, originating depository financial institutions will pay an interbank fee for each forward transaction. [9/29/15]

- Interagency Webinar to Address Fair Lending

Registration is now open for a free, 90-minute joint agency webinar on Fair Lending. The event, which is being sponsored by the Federal Reserve, is scheduled for Oct. 15th at 2:00 P.M. EST, will address issues ranging from how to use your data to evaluate fair lending risks to compliance management and pricing to post-origination risks. [9/29/15]

- Federal Reserve System to Sponsor Fair Lending Webinar

On October 15, 2015, the Federal Reserve System will host a fair lending webinar. Participating agencies will include NCUA, CFPB, the FDIC, the OCC, the DOJ, the Federal Reserve Board, and the Department of Housing and Urban Development. A wide range of subjects will be discussed, including developments in mortgage lending, compliance management, pricing, and the use of data to evaluate fair lending risk. [9/29/15]

- A Potential Headache: Not Everyone is Happy with Fed Same-Day ACH Rule

The Federal Reserveâs new ACH Rule is drawing considerable criticism for two particular issues: the rule that requires that receiving depository financial institutions (RDFIs) must accept same-day ACH transactions and that they must incur the costs for processing those transactions. Many small credit unions argue that they should have the opportunity to opt-out of same-day transactions. [9/28/15

- CUNA: Should the Fed Raise Interest Rates?

"By maintaining near-zero interest rates, is the Federal Reserve helping or hampering the economy?" That was the question used for an hour long debate between two CUNA economists. What would be best for your financial institution? [5/21/15]

- CUNA Expresses Concerns About Reg. D Transaction Limitations

CUNA has sent a letter to the Federal Reserve Board, the FDIC, and the OCC in which it states that the transaction limitations on savings accounts have outlived their initial policy purposes and adversely affect credit unionsâ ability to serve their members. In addition, CUNA expresses concerns about proposed changes to Reg. CC that could pose challenges for RDC transactions. [5/14/15]